Lithuanian investment in Belarus: success and failure

Sowing Success

1. Vakaru medienos grupe & SBA

On 28 February 2011, UAB Vakaru medienos grupe (VMG) and the Republic of Belarus signed an investment agreement on the implementation of the investment project “Establishment of a vertically integrated wood processing complex in Mogilev region in the territory of Mogilev Free Economic Zone”. The foreign limited liability company VMG Industry, founded and registered as a resident of the Mogilev Free Economic Zone in June 2009, was selected for implementing the investment project. The investment project involved investments in fixed assets totalling EUR 58.264 million, and attracted EUR 64.3 million worth of Lithuanian investments to Belarus and resulted in the creation of at least 870 new jobs. The investment project was financed by the European Bank for Reconstruction and Development and a few German banks.

Also on 28 February 2011, the foreign limited liability company Mebelain (an SBA group company) and the Republic of Belarus entered into an agreement on implementing the investment project “Construction of a furniture manufacturing facility in Mogilev Free Economic Zone”. Mebelain was registered as a Mogilev FEZ resident back in April 2010. The business plan of Mebelain’s investment project provided for investments in the amount of EUR 15 million (including EUR 8.2 million investments in fixed assets), setting up to 270 new jobs and the export of 100% of the goods it produced.

At the beginning of July 2013, Vakaru Medienos Grupe and SBA successfully opened an industrial complex worth more than LTL 325 million in the Mogilev FEZ. The joint project is going to be one of the largest foreign direct investments in Belarus by Lithuanian investors.

VMG Industry representatives emphasize that the easy access to raw materials (timber) and their good relationship with the local authorities of Mogilev were important factors that determined their investment decision. Initially there was great uncertainty as to whether Belarus would let a furniture manufacturer in the country, however, the plans for exporting considerably facilitated the negotiation process. A joint venture of furniture manufacturers enables efficient communication with suppliers and reduces logistics costs. According to the representatives of SBA group, the purpose of the factory in Belarus is to consolidate SBA’s position in Eastern markets, where they see a strong potential for development and growth in consumer purchasing power. At the same time, as a part of the Customs Union, Belarus provides better opportunities for Mebelain to sell its products in CIS countries with its considerable resources of raw materials and an old furniture manufacturing tradition.

2. Arvi group

Arvi group has two investment projects in the Lida District in the Grodno region of Belarus worth EUR 27 million in total.

The first project, valued at about EUR 20 million, envisages the building of a turkey meat production facility. The company plans to produce up to 5,000 tonnes of finished products per year. This will be a vertically integrated facility engaged in turkey breeding (about 420,000 turkeys per year), production of combined fodder (about 40,000 tonnes), slaughterhouse activities (6,000 tonnes of live weight turkeys), and production of finished and semi-finished turkey products. The project is going to be localized in Belarus and will create 210 new jobs.

The second investment project involves the technical upgrade, renovation and capacity build-up of the Lida Veterinary Disposal Plant (with the project worth around EUR 7 million). An animal waste disposal facility will be built in the proximity of the Lida Veterinary Disposal Plant. It will boast top-notch equipment and technologies which will provide capability of producing up to 5,700 tonnes of tankage and up to 2,800 tonnes of inedible fat per year to meet domestic demand.

Both projects are financed by BPS-Sberbank and are anticipated to be implemented by 2017. The first output is expected to be produced in 2015.

Arvi’s top management believe that unexploited potential on the Belarusian market is vast due to very low levels of turkey consumption. Per capita annual consumption of turkey products in Belarus is less than 100 g, compared with nearly 3 kg in Lithuania. The investor believes that even reaching production volume of 1 kg per capita, meaning at least 10,000 tonnes per year, would be a great success.

3. Viciunai group

The Lithuanian surimi producer Viciunai group has invested in the construction of a seafood processing plant and logistic hub in Belarus. More specifically, two companies, Viciunai Bel and Viciunai Logistic, were registered in Belarus. EcoFort Company, one of Viciunai group companies, supplies and distributes frozen and chilled products under the Vici label on the local market and is a partner of the project. Initially, the capital to be invested was estimated at USD 5 million, while USD 3 million was planned to be invested during the first stage of the project of the logistic centre. The project of construction of the plant in Belarus was being developed for several years.

EcoFort sells Viciunai Group manufactured products in Minsk, Gomel, Mogilev, Brest, Vitebsk, Pollock, and Grodno as well as in other locations. The company represents Viciunai group trademarks VICI, ESVA, and Columbus. The company also represents international trademarks Dujardin (frozen vegetables) and Lutosa (frozen fries). The lion’s share of its sales in Belarus, serving 800 shopping outlets, comes from the sale of surimi products, breaded fish products and frozen pizzas (the market leader in pizza sales). Since 2006 crab sticks VICI have been annually winning the nomination “Choice of the Year”, while VICI pizzas were nominated for “Choice of the Year” in 2009.

Now Viciunai Group intends to move some of its manufacturing operations from Kaliningrad region, the Russian Federation, to Belarus. To that end, Viciunai Group has taken out a lease of land plots in the free economic zone in Belarus for the purposes of constructing a plant. Viciunai Group believes that its goods will reach customers in Russia’s major cities and in Kazakhstan one and a half days faster than from Kaliningrad region, because manufacturing in Belarus means fewer border crossing points that its goods have to pass through.

The Sting of Failure

1. Vladimir Romanov’s group in Belarus

In the mid-2000s the founder of Ūkio bankas, Vladimir Romanov, started doing business in Belarus. Sponsoring the MTZ-Ripo football club was one of the conditions for his investment project that he planned in Minsk. In 2005, Belarusian President Alexander Lukashenko approved Mr. Romanov’s investment project. Apart from building apartment houses in residential areas on the outskirts of Minsk, Romanov’s company ŪBIG planned to reconstruct Traktor Stadium, the second largest football arena in Minsk. The development plan included the construction of a shopping mall, a business centre, an indoor sports arena, a hotel, and a parking lot next to the stadium.

In 2007, an investment agreement was signed between ŪBIG and the Minsk City Council. Based on the agreement, the joint stock company (JSC) Stadium, an SPV, was established in order to implement the project. The SPV had to implement the development plan. The investment was valued at EUR 250 million.

The project was intended to be implemented until 2010, however, the construction of the complex was not even started. At the beginning of 2010, Minsk City Council terminated the investment agreement with Mr. Romanov. ŪBIG has been accusing Belarusian authorities of unreasonable delay of the project. According to public sources of information, it is most likely that the main reason for the conflict was the fact that instead of reconstruction of Tractor Stadium, JSC Stadium started to build residential houses in Minsk’s suburbs. When Belarusian authorities stopped supporting Romanov’s business, he announced his withdrawal from sponsoring FC MTZ-Ripo. The investment dispute will be heard before the International Court of Arbitration in Stockholm.

2. The Case of Vingės terminalas and Alvora in Belarus

In April 2013, the Belarusian company Belintertrans and UAB Vingės terminalas agreed on the commencement of the construction of a transport and logistics centre in the Volozhin Region, Minsk Oblast with the plans to spend an estimated USD 25 million. UAB Alvora, a major Lithuanian construction company with extensive experience of building logistics terminals, was to build the facility. The future transport and logistics centre was intended to service commodity traffic from CIS countries and Europe and to have offices, modern terminals for storage and customs clearance of cargoes. UAB Vingės terminalas announced that it was going to invest LTL 62 million in the logistics centre together with partners. The terminal would become one of the ten largest logistics facilities in Belarus and at the beginning of its operations was described as a model project of foreign investors.

The first construction stage was finished, however the second one was not even started, because a disagreement between the partners resulted in a big investment dispute heard before the Supreme Commercial Court of Belarus. The shareholders of the logistics centre operator Belvingeslogistik – UAB Vingės terminalas, UAB Alvora and Belintertrans, were accusing the counterparties of an attempt to push the partners out of the joint venture and take over the management of the logistics centre.

The Supreme Commercial Court of Belarus called for an amicable settlement between the parties, and it was announced at the beginning of March 2013 that Vingės terminalas had reached a verbal agreement with Belintertrans. At the same time the CEO of Vingės Terminalas stated that they would refrain from commenting any details until there is a document setting out how the agreement will actually be implemented.

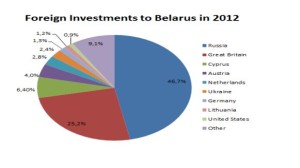

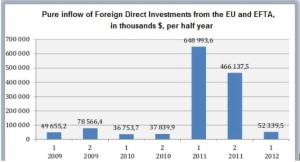

Foreign direct investment: http://www.theglobaleconomy.com/Belarus/indicator-BX.KLT.DINV.WD.GD.ZS/

http://belarusdigest.com/story/wh-invests-belarus-13783

We deliver, UAB is not responsible for advertisers content or information published graphical material Contacts: +370 (613) 87583, info@wedeliver.lt