China Wants to Have a Compliant Middle Class

by Arunas Spraunius, Baltic Economy journalist

From time to time, especially in the public domains of Russia and China, calls are made to create a so-called de-Americanised world. In one of the most recent comments discussing this inexorable expectation, an editorial in The Wall Street Journal weekly on October 21st wrote that the frontrunners to the leaders of a de-Americanised planet get their allies, if any, mainly through the use of coercion.

For instance, in trying to keep pro-Russian Edgar Savisaar in the post of the mayor of Tallinn (it is unclear, however, how much de facto pro-Kremlin he is), Moscow even announced an international search of his main competitor. Kremlin efforts to restore the Soviet empire by any means caused concern in the official Riga in late October.

On the other hand, Western negligence sometimes leads to the aggression of other countries, and especially Russia. For example, the suspension of the U.S. government because of rather futile ambitions and a lack of responsibility among Washington politicians, and reoccurring rumours of a potential bankruptcy of the United States, evoked a variety of opinions in the world. Lone China in the Southeast Asia might think: “...Why not me?” It is a circumstance that speaks for itself – when U.S. President Barack Obama refused to take part in the Asia-Pacific Economic Cooperation summit in Bali in early October because of the crisis, the current Chinese leader, Xi Jinping, became the main celebrity of the summit. So this time, a Chinese breakthrough did occur, at least symbolically.

Towards a liberal economy...

Moreover, Beijing was forced to follow the crisis in America with anxiety. After all, China is a major creditor of the United States; its central bank holds U.S. government securities worth more than 1 trillion U.S. dollars. This means that, despite the tensions, Beijing still trusts (or simply has no other choice) the U.S. financial and political system. However, in the editorial article of The Washington Post of October 9 “Does the U.S. deserve its world-class credit rating?” they point out with sarcasm that at the time, Washington’s crazies can be actually be dangerous to political stability not only in the United States, and not only theoretically. However, these and similar reflections in the American and the global media had no significant effect on Chinese actions, because in the modern world, the big players are too dependent on each other to afford any ambitious movements, and focus on instantaneous problems, rather than the long-term balance of power.

In any case, the fact that China is buying U.S. securities, rather than vice versa, suggests that the economic model based on the needs of the U.S. is currently still operating in the world. And the day when Beijing, declaring from time to time that the communist system is better than American "capitalism", will disengage from the U.S. economy, has yet to come.

But it would be wrong to say that China is not satisfied with this situation. Being pragmatic, the Chinese are very well aware that the principle according to which the global economy functions today provides highly favourable conditions for China to earn U.S. dollars and thus transform its economy and increase its potential. After all, now the Chinese can quietly but surely build themselves a bridgehead, and victoriously take over the control of the global financial pyramid. But, as usual, China is only ready for change with the condition that everything remain under control, and without risk to the Communist Party’s hegemony.

This approach also dominated in the ruling Chinese Communist Party’s plenum on November 9-12 – it outlined the country's economic development guidelines for the next decade. As announced by the Western media with a certain satisfaction, although the wording is traditionally vague, it is clear that the free market will play a key role in the future. According to the Financial Times, the state is planning to gradually abandon price regulation in a number of economic sectors, as well as to eradicate the disparity between the status of urban and rural land. It is believed that this will facilitate more rapid urban development. The plenum also set the stage for the liberalization of the exchange and interest rates.

Plus, there are also signs of abolishing the compulsory registration which keeps rural residents attached to their place of residence. The Chinese communists have already realised that the registration hampers the country's development, as it prevents villagers from settling in cities with their families – currently, in coming to the big city illegally, family members lose their right to education and medical care. Beijing also promises to change the rights of ownership so that non-urban residents have the same rights to land as the urban population. This could mean that Chinese peasants moving to large cities might be allowed to sell their land in the future.

But again – strictly under the guidance of the Communist Party…

However, the summarizing plenum document (communiqué) points out with obvious authority that the state-owned companies will maintain their power and monopoly in economic sectors such as banking, energy, telecommunications and transport. Although the communiqué states that the free market will play a key role in the country’s economy, the decisive impact of the Communist Party has not been omitted. This is reflected in the actions of Xi Jinping – he promotes the old-fashioned rhetoric of supporting the Communist Party as the main ideological power, while at the same time suppressing the political free mind, in particular among online commentators (some have already been arrested and are awaiting trial).

Interestingly, the Chinese Communist Party is planning to set up a State Security Committee, which is likely to reinforce the powers of the country's president to control the military. Western press sources predict that this committee will act in the same way as the U.S. National Security Council. So, this is another, although formal, copycatting of the U.S., but of course, adapted to the realm of a huge country still liberating itself from totalitarianism.

Paradoxically, in many areas of the economy and even in social infrastructure, the Chinese attempt to copy the West, but at the same time have a paranoid fear of not only changing the economic, but also the political system. This paranoia can be explained by the fear characteristic to all autocratic leaders of the state that as soon as you release the reins, multinational corporations will exploit your vulnerabilities and impoverish your country in the blink of an eye. That explains why the current Communist Party elite is driving the Chinese economy towards a liberal free market (by the way, the main economic adviser of the ruling class is a liberal, Liu Sheng), while adhering to conservative communist ideological traditions.

Integration with international structures such as the World Confederation of Labour, the World Trade Organization, and the International Monetary Fund also forces adherence to the rules of the world. This can also be seen in competition all throughout the world. Globalization habits and in particular, the rules of global capitalism as "tested" by the U.S., penetrate China, sometimes in unseen forms. For instance, among 820,000 foreign students in U.S. universities during the academic year of 2012-2013, a total of 235,000 Chinese students were leading without competition.

The Forbes magazine issue of July 30 cited Ruchir Sharma, an economist of the Morgan Stanley financial services company and author of the book Breakout Nations, who stated in an interview with the officious China Daily, that China will be the only country of the four major developing countries (the other three are Brazil, Russia and India) to achieve a high living standard, as defined by the World Bank (more than 12,000 U.S. dollars per year). If the country's economy grows by 5-6 percent over the next few years, the average income per capita in China will double to about 20,000 U.S. dollars per year. But the most important question is not whether they will achieve it and when it will happen, because the process is beneficial for the global economy in the first place, but what will happen to China when it has a large middle class.

The young capitalism is being exploited by everyone who can…

After numerous scandals of the Taiwanese Foxconn company related to the tragic deaths of its young workers who could not bear the stress of working there (the company has earned the nickname, “the Suicide Factory”), at the end of July, the focus shifted to a U.S. corporation, Apple Inc. In order to diversify its production, it cooperates with another Taiwanese company, Pegatron. A New York based NGO, China Labour Watch, raised the question of how Pegatron succeeds in reducing the cost of its production. This turned out to be, by using methods that were prevalent in America during the first half of the last century.

China Labour Watch's report refers to 80 violations of the labour, production and environmental codes that were found to exist at Pegatron, ranging from failure to comply with environmental laws, taking away the passports of workers (preventing them from fleeing to another company), to unbearable conditions in the factories, exploitation and child labour. Moreover, low wages force the company’s staff to work overtime. It turned out that 700,000 workers employed in the three Pegatron factories are forced to work an average of 66-69 hours per week.

Of course, Apple received a serious blow to its reputation – after all, the Pegatron companies make components for its new iPhone model. However, only hypocritical representatives of China were surprised by these reports. It was as if they had forgotten that China's success story began with a cheap labour force. So, it will take some time before what has become a normal practice to become an intolerable thing of the past (and, if China's non-governmental organizations actually begin to fight for the rights of working people, rather than simply run propaganda against Chinese manufacturers, Huawei's competitors).

In any case, it is clear that the era of uncontrolled cheap labour in the world is about to end. Multinational corporations will have to seek a new location for their manufacturing operations or have to adapt, which usually means paying more. That would be one of the changes benefiting China's economy, and raising the per capita income level. However, when we talk about the actions of China Labour Watch defending the rights of the working people, which may be useful for the Chinese economy and certain Chinese companies, we should not overlook other phenomena that could symbolize much deeper tectonic fractures in society.

On November 13th, the Japanese newspaper Asahi Shimbun announced a publication with a revealing title, Explosion in Shanxi: What is wrong with China?, telling the story of several bombings in a provincial capital in the western part of China near a Communist Party headquarters.

Accurate identification of what the cause of the explosions was is not easy. However, it should be noted that Shanxi produces most of the Chinese coal that fires the majority of the country's power plants, which in turn, supply cheap electricity to maintain the economic competitiveness and growth. Public corporations and many small and medium-sized enterprises operate within the province, and a number of businessmen were able to capitalize on the government-controlled economic promotion policies of the backward western regions, ignoring work safety in the mines or slave labour, where kidnapped individuals and even people with mental disabilities were forced to work. In addition, many people had to flee their homes because of the development of the coal fields (in this case, it should be noted that aggravating environmental problems cause public discontent in China).

The Chinese people have become increasingly intolerant to such injustices – especially to social exclusion, which is particularly rampant in China as compared to the rest of the world. A Japanese newspaper has presented statistics that allegedly show that the number of demonstrations and acts of resistance in the country is growing fast – from 60,000 in 2003 to 180,000 in 2011. Accordingly, the cost for Beijing to maintain public order (in China it is called the cost of public safety) has increased from 330 billion yuan in 2007 to 700 billion yuan in 2012, surpassing the defence budget.

The growing protests indicate that the Chinese are following what's going on in the world, and learning to fight for their rights. The only difference is that they convey their protests in Chinese forms and use Chinese phraseology. For instance, peasants, deprived of their land by corrupt officials in the course of the current reform, write in their appeals to a higher authority that their goal is not to turn over the Communist Party, but that the government should not violate the so-called “heaven mandate” granted to it (in China, the rule of law has been based on it for centuries).

While the Chinese Communist Party leaders see each new issue as an opportunity to promote economic growth by investing the U.S. dollars earned from foreign trade, simple Chinese people have to live with these problems.

Is it possible to control the middle class?

According to the Sinology lecturer of the Centre for Oriental Studies at Vilnius University, Vytis Silius, China's economic model is approaching the Western model. Undoubtedly, it has specific Chinese features. So far, it is only in the level of testing and social experiment. For example, some provincial towns have attempted to install a democracy, where a local community solves its problems by voting and elects the local government. It is argued that the Chinese are satisfied with this, because traditionally, democracy for them is most important at the grassroots level – local communities – and they do not really care about electing the highest powers in the country. However, monarchs that once had power in many countries of the world, failed to preserve it. So nothing is eternal. Everything changes. Traditions are also not forever, no matter how strong they are. Therefore, while watching the solutions currently being implemented by China, both China and the Western countries will have to answer a lot of questions – which will determine what the world will look like in the 3rd decade of this century.

First of all, the question is whether China, in seeking to free itself from economic dependence on the exports of cheap labour and to create a strong middle class, which might boost and stabilize consumption within the country, will be able to perform this transformation without the democratisation of its political system. This question is very interesting – after all, a democratic environment is more favourable to creativity and innovation, so during the migration from textiles to high-tech industry, and in order to be a leader in a transparent competition, the dominance of an infallible party can become a nuisance. On the other hand, the current system makes it possible for China to consolidate its business stronghold in the global market, making use of the state apparatus and control, together with structural and financial support, to achieve positive results. However, in this case, the U.S. and the EU will have to answer the question of how long they will tolerate the competitive distortions where private Western corporations have to compete with Chinese state-owned companies involved in banking, energy, telecommunications and transport.However, a key question that the future will inevitably answer is this – Will the emerging middle class of China want to live in the shadow of an ideological and unerring political regime? It may be all very well for Russia to control the situation, when individuals serving oligarchs account for a greater part of Russia's middle-class. Therefore, by controlling oligarchs you control the middle class. How China will control their own middle class and how much the latter will allow itself to be controlled is still a mystery, as tales about the dangers of democracy because the Communist Party could lose power and then everything would come under the control of a mid-level clerk of a U.S. company, can be only told to the exploited and poor part of the population, while it is much more difficult to deceive the middle-class. Its representatives understand what the leaders fear most, and who is responsible for the assets of certain players to grow by billions every year, while they end up living in a polluted environment.

Why Television Is "Dying" in Sweden, But Not in the East

Sometimes it's hard to understand why in some countries progress is much faster than in others. However, systemic causes usually are the same, and their analysis allows one to grasp the essence of the processes in separate business sectors. Want to understand why in Sweden or Denmark Internet prevails, and in China or India televison is still in power? Read the article.

Key words: Media market, Media in developed countries, Media in less developed countries, Internet, TV, Internet advertisment, TV advertisment.

NASDAQ OMX Baltic – Three Countries, One Market

by Ott Raidla, NASDAQ OMX Baltic Market Communication & Marketing Manager

NASDAQ OMX Baltic operates three stock exchanges and three central securities depositories in Estonia, Latvia and Lithuania under one Baltic roof, providing the capital market infrastructure across the whole value chain – from listing, trading, and market data to clearing and settlement and safe-keeping of securities.

NASDAQ OMX Baltic exchanges are a part of the world’s largest exchange company NASDAQ OMX, thus ensuring great confidence in Baltic securities market for international investors, offering a market infrastructure in accordance to the international industry standards, world’s fastest trading platform and high listing standards.

The Baltic Market offers a comprehensive, efficient and secure marketplace, regulated to global standards for companies to raise capital and for investors to transact and settle financial products seamlessly between the three countries.

In the recent years, NASDAQ OMX Baltic exchanges have focused on removing frictions to cross-border investments and leveraging on the regional integration. The essential elements of a single Baltic marketplace like shared global technology, one market model, joint membership, common information distribution and other have been put in place, making the region easier accessible and more attractive to local and international investors, as well as companies seeking to list their shares on the stock exchange.

By introducing a single trading and settlement currency as Latvia joins the euro area in January 2014, NASDAQ OMX Baltic will take another step to become a truly integrated market. The single currency across the Baltics will greatly improve the efficiency of the Baltic market and facilitate capturing larger flows of portfolio investments to the region. For foreign investors the common currency will reduce transaction costs through savings in conversion expense, allow for smoother management of cross-border portfolios, as well as diminish trading-related risk.

Baltic tiger is roaring

The Baltic region has demonstrated remarkable agility by quick recovery from the recent economic crisis. Estonia, Latvia and Lithuania have been the fastest growing economies among the 27-member states of the European Union for the last three years. Latvia's GDP in 2012 as compared to 2011 increased by 5.6%, while Estonia's GDP grew by 3.2% and Lithuania's by 3.7%.

During the past 3 years NASDAQ OMX Baltic Benchmark index which is composed of the largest Baltic companies covering different sectors advanced by more than 40%, since the beginning of 2013 the index has grown by 12%.

More opportunities to raise capital

As Baltic economies are steadily growing, so is the capital market. Expanding list of corporate bonds proves that there is a great alternative to bank loans. And this alternative is likely to become more attractive for companies, as the regulations and requirements imposed on bank lending are becoming stricter. There are more and more opportunities for companies to diversify their capital base and attract growth capital using stock exchange instruments.

IPO as a source of attracting capital could be as beneficial for large companies, seeking funding for expansion, as for small and medium size enterprises (SMEs) who cannot access bank loans for various reasons.

As SMEs constitute approximately 99% of all companies in the Baltics, their valuable role in the economies cannot be overestimated. The importance of SMEs has been accurately characterized in a program, which aims to boost the IPO market in Sweden (“IPO White Paper”). The significance of SMEs in Swedish economy has been growing constantly over the recent years. For example, in the last decade about 80% of the new jobs in Sweden were created by the companies with fewer than 50 employees. It seems reasonable to assume that the situation is similar in the Baltics. Taking this into account, it is important to ensure that SMEs and start-ups have the opportunity to get an easy access to capital if they need to.

In addition to the regulated market, NASDAQ OMX Baltic has an alternative market called First North Baltic. First North is designed specifically for SMEs and start-ups and has much looser regulatory requirements compared to the Main and Secondary lists. Two companies – Baltic Telekom and Telescan – joined NASDAQ OMX Baltic Alternative Market First North in 2013.

The main purpose of the alternative market is to serve as an entrance point to stock exchange for SMEs. Usually, these ambitious companies grow and seek to become the main list companies in the future. The alternative market can boost a company’s visibility and create better conditions for finding investors for further financing.

As a matter of fact, the Swedish IPO White Paper also reveals that the job growth in the companies which went public increased by 36.5% annually during the years following the IPO (by comparison, the average job growth rate in private sector companies in Sweden is 1,5%). This proves a positive link between access to capital by SMEs and job creation.

We believe that what determines success is not how large or small the market is, but instead whether the market is growing or shrinking. As Baltic countries are standing firmly on the path of sustainable economic growth, we believe the IPO and listing trends which we witness all over the world will gain momentum also in the Baltics.

Baltic Market Quick Facts (in a separate box)

79 listed companies

33 members

29 corporate bonds

45 government bonds & bills

5.7 billion euros - market cap

3,265 euros - average transaction

23.92% - increase in the Baltic Benchmark Index y-o-y

OMX Baltic Benchmark GI index (26.11.10-26.11.13) (in a separate box)

10 largest companies by market capitalization

Tallink Grupp (TAL1T) – 643 MEUR

TEO LT (TEO1L) – 595 MEUR

LESTO (LES1L) – 428 MEUR

Olympic Entertainment Group (OEG1T) – 283 MEUR

Lietuvos energijos gamyba, AB (LNR1L) – 241 MEUR

Tallinna Vesi (TVEAT) – 226 MEUR

Tallinna Kaubamaja (TKM1T) – 223 MEUR

Lietuvos dujos (LDJ1L) – 185 MEUR

Ventspils nafta (VNF1R) – 145 MEUR

Apranga (APG1L) – 139 MEUR

NASDAQ OMX Baltic Market Awards – honoring excellence in investor relations (in a separate box)

Each year NASDAQ OMX Baltic exchanges identify the best companies in the Baltic market in terms of investor relations and award them during the Baltic Market Awards ceremony.

The Baltic Market Awards project, alongside with evaluating investor relations, identifies the best financial intermediary – a bank or a brokerage company trading in the Baltic company shares – and awards it as Member of the Year.

The Baltic stock exchanges have been carrying on the Baltic Market Awards project since 2006.

Best investor relations in the Baltic countries in 2012 – TEO LT

Best annual report in 2012 – TEO LT

Best investor relations online in 2012 – TEO LT

Most visible improvement in investor relations in 2012 - Latvijas kuģniecība

Member of the year in 2012 – LHV Pank

Overall in the Baltic market, the quality of investor relations of the listed companies has improved by 46% since the first Baltic Market Awards in 2006.

Source: www.nasdaqomxbaltic.com

If you want to know how Estonia, Latvia and Lithuania look like after crisis, in Baltic Economy magazine you can find the opinion of well-known economic experts (Hardo Pajula from Estonia, Andris Strazds from Latvia and Gitanas Nauseda from Lithuania), who will help you to understand the economic situation in Baltic Tigers as it is today and is going to be in the nearest future. What lessons they have learned, what helped them to overcome the crisis, what are their economic ambitions and economic challenges they will have to deal with in 2014 – all is here.

Key words: Baltic states‘ success story, Austerity economic policy, Baltic export recovery, Middle income trap, Balance of payments in Baltics, Baltic real estate bubbles, Introduction of Euro in Latvia, Introduction of Euro in Lithuania, Baltic emigration, Scandinavian banking in Estonia, Procyclicality of economic policy.

What Do Baltic Real Estate Promoters Dream About?

by Monika Poskaityte, Baltic Economy journalist

In 2007, when the future of the Baltic countries didn’t look resplendent in gold, but it was at least pink, I met a 22 year old Swede on a plane to Vilnius. The fourth-year student was flying to Lithuania, hoping to become a millionaire in a few years – an investment in the Lithuanian economy, then growing at an incredible pace, and in real estate in the Baltic countries, seemed like a gold mine to him, where you do not even need to dig. And he was not the only one to think this way. Hopefully, this young man did not buy the real estate that was supposed to turn into mountains of gold ...

Today, now that we know how the Baltic Tigers’ history ended, we can see his flight across the Baltic Sea from prosperous Sweden to Lithuania as a folly. However, were those who as recently as in the crisis of 2008, seeing the terrific fast growth of profitability of investments, thought it was the result of a new model of the world economy, rather than an investment bubble, equally foolish? And what to think about those who were too lazy to even look deeper into the fluctuations of the gold price during this century, and believed that even though the price was reaching record highs, it would continue to grow? The gold rush fever got its name specifically because it is based on hope rather than logic; the belief that if others succeeded in easily making their fortune, I will succeed, too.

Therefore, when a bubble is emerging in the market, an increasing number of people begin to believe that this is a real and safe opportunity to earn. It is for these reasons that we should have responsible financial and tax policies that would reduce the potential for bubble formation. Without a doubt, you can’t control all bubbles, because some of them are global, but the most negative influence is usually caused by bubbles formed at home. Therefore, when today's Baltic economies are growing very rapidly in the European Union (EU) and their real estate companies constantly share information in the media about the recovering real estate market, it is a good time to decide whether to take interest of the opportunities of investing in the real estate of the Baltic real estate market, and to check if it is more secure today. Maybe you should wait again for a new bubble?

The Swedish BANG and the Baltic bang-bang-bang

During the last crisis, the burst of the real estate bubble did not come to Sweden for a good reason – the country had already learned its lesson in the most painful way. In the middle of the ninth decade of the last century, construction in Sweden intensified because about 4 per cent of the country's gross domestic product (GDP) was spent for subsidising it. At the same time, loans were becoming cheaper because of inflation, until the experts of Uppsala University finally estimated that the interest had actually become negative because of tax preferences! The last ingredient in the cocktail was aggressive lending, which reached 150 percent of the national GDP because of the loan portfolio.

A great BANG awaited Sweden in the 1990s. In 1990-1995, residential property prices fell by about 25 per cent, commercial properties – by an average of 42 percent, while bad loans rose by 5 percent. Sweden was expected to devaluate the kronor, so the currency market was flooded by a wave of speculation. The Swedish central bank hoped to put them off by increasing the interest rate by 500 percent. But this did not help either: it ended with the nationalization of two banks – Nordbanken and Gotabanken. It cost the country's budget 4 per cent of GDP, or 64 billion Swedish kronor (today, this would amount to about 18.3 billion U.S. dollars). By the way, the Swedish government only sold the last 7 percent stake of former Nordbanken in September this year.

However, the strict actions of the Swedish central bank and politicians have yielded results – the consequences of the bubble burst were eliminated in about seven years. To achieve this, Sweden has adopted many other amendments: nationalised banks could only get government assistance if they agreed to write off bad assets as losses; additional supervisory authority (Bank Support Authority) was established; the regulation of banks was tightened and the kronor was devalued. Then, tax reform was introduced: tax rates for employees were reduced, but the tax base was increased, and capital and dividends were taxed at higher rates. In analyzing the solutions of the crisis, economists note that one of the essential elements of success is the political elite's ability to achieve consensus and structural changes. After the crisis, Sweden could boast of having the most stringent regulation of banks in Europe, and the economist Paul Krugman suggested they should apply the experience in the United States in 2008.

However, in addressing the situation at home with extreme caution, Swedish banks have turned a blind eye to their activities in the Baltic countries, or maybe the emerging economies seemed so attractive that no one wanted to spoil the party with discussions on the lessons learned in Sweden, necessary restrictions and tighter regulation? The truth is, though the small bang-bang-bang of the Baltic States reminded me of the Swedish case, there were many more assumptions made that allowed real estate bubble to form here. According to the analysts, when Scandinavian banks came to the Baltic countries, confidence in these markets increased, so the cost of loans was falling, and foreign investment was growing. Invitation to access the EU contributed to even greater investor confidence. Wages rose, expectations were skyrocketing – the Baltic Tigers seemed unsurpassable. For example, in the decade before the recession, Estonian real estate went up 352 percent! Let’s compare: during the same period, the prices of properties in Germany experienced the slowest growth – just 1 percent.

While real estate prices were rising at a dizzying rate, Lithuania was considering a discussion on the introduction of a real estate tax to reduce the bubble formation rate and prevent it from exploding. It may be hard to believe today, but representatives of the largest real estate companies, in the light of such proposals, recommended looking at the real estate prices in London or Paris. They believed that they had to prove to the public that the real estate prices in Vilnius and Riga still had a great potential to rise. By the way, in trying to understand why politicians and the central banks of the Baltic countries did not take any serious action to stop the formation of the real estate bubble, it is not only necessary to pay attention to the influence of the promoters and intermediaries of real estate projects and the desire to profiteer from the bubble blowing, but also the political investments in real estate, and the influence of the real estate bubble on the economy. The rapid growth of real estate prices has a positive impact on the construction sector and the overall economy growth, so for politicians, it is often much easier to relax and enjoy a fast-growing economy, rather than making unpopular decisions restricting the availability of credit or the attractiveness of real estate investment by increasing the share of tax in the sector. So, the lack of social responsibility among politicians and business, and ignoring the Swedish lessons were the main reasons why the real estate market downturn was so huge.

The explosion took place throughout all the Baltic States: the housing price index in the Baltic countries fell by almost half, according to Ober-Haus Valuation and Market Research Department manager, Saulius Vagonis, from the highest price level reached during 2006-2007, to the bottom reached during 2009-2010. In Vilnius, apartment prices fell by about 40 percent, in Tallinn – 50 percent, and in Riga – by as much as 60 percent.

However, to combat the consequences of the downturn, the example of Sweden was used and, according to the manager of the Consultation and Analysis Department at Inreal, Arnoldas Antanavičius, the same errors were not duplicated. "A number of similarities can be seen between the explosions in the Baltic countries and Sweden, but with companies going bankrupt in Sweden, banks rushed to sell the seized property. Under these circumstances, the real estate prices fell further, so not only did the bubble burst, but all the air escaped through the holes. Banks in the Baltic countries created subsidiaries and took over the seized property, but did not rush out to throw it on the market – it is being sold more actively now, when it is obvious that the prices are recovering,” says A. Antanavičius. “In an attempt to get out of the recession, the Baltic countries took a different strategy, and we are already seeing a rise in all the major cities. For example, in Vilnius we already saw the first signs of it last year. So far, regions and smaller towns are still lagging behind, so you can guess that the recovery will be delayed for a year or two there." According to Ober-Haus, since October 2010, apartment prices in Vilnius have risen by 2 percent, in Riga – 11 percent, and in Tallinn – by as much as 35 percent. "It seems that prices are recovering the slowest in Vilnius, but do not forget that it was hit the least", said S. Vagonis.

Both prices and the construction cranes are rising in the Baltic countries

During the downturn, there were almost no new projects, so the Baltic countries are not only now facing the growing expectations of consumers, but also the rapidly growing demand for real estate.

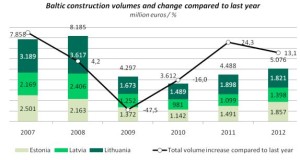

This intensifies the construction sector. The board chairman of the Estonian Merko Ehitus construction company implementing projects in the Baltic countries, Andres Trink, says that the construction sector has been growing over the past two years: "Much of this growth was due to public sector orders. However, bearing in mind that the year 2013 is the last year of the EU funding period, I think that the share of the public sector projects will decline in 2014. However, about half of the Merko Ehitus contracts launched in the Baltics were private orders in 2013. The situation with housing projects in 2013 is probably the best since 2008; the number of projects is growing, but the prices are still about 30 percent lower than the record high in 2007. Thus, rapid growth poses no threat. I would be more critical about office projects – very few new projects have been started recently.” According to A. Trink, the main reason is quite low rental prices, making office projects less attractive.

However, Vilnius is distinguished in the office segment: now, about 13,000 square metres of construction is being completed, over 40,000 square metres of construction is currently pending and another 30,000 square metres of office space has been planned. In 2013, the office space for rent, according to Ober-Haus, amounted to 467,000 square metres, so the supply will increase in the very near future. However, according to real estate experts, the growth should not become a concern: vacant office space in Vilnius is only 8 percent, in Riga, where the total office space area is 679,000 square metres, it is 14 percent, and in Tallinn, where the total area is 579,000 square metres, they have about 9 percent of vacant office space. Thus, the activation of new projects in Vilnius should not come as a surprise. "I would say that the current projects were launched on time, but I think that the future demand will be satisfied for a while", said A. Antanavičius.

Particularly noteworthy is the exclusive real estate market. According to the co-owner of Baltic Sotheby’s International Realty, Paulius Gebrauskas, the market is especially active in Latvia, where in 2010 they passed a law allowing free residence in Latvia and free travel in the Schengen area for everyone who acquired real estate for more than 142,000 euro, and their family: "80 percent of the market buyers in Latvia are foreigners, but they have currently launched a debate on the amendment or withdrawal of this law, or maybe the introduction of quotas. These changes may also affect the real estate situation." According to P. Gebrauskas, exclusive luxury properties are less sensitive to volatility and less dependent on the credit markets: "During downturns, luxury real estate prices dropped by 20-30 percent, but they were the last to fall, and today we can talk about a price level comparable to that before the crisis. However, there were no new projects during the recession, so the market demand currently exceeds the supply."

The last chance to earn or another opportunity to lose?

All of these trends suggest that the real estate market recovery in the Baltic countries is no longer a question, but at the same time it is clear that confidence in the longevity of this process is not high. According to A. Trink, the bubble explosion forced the abandonment of long-term plans – earlier, projects were planned for three to five years, and now it comes to plans for only 6-12 months. This cautious approach is well understandable and is linked not so much with the processes in the Baltic economy, but with external factors of which the real estate project promoters are afraid and which may scare away buyers. This includes the slowing Russia's economic growth, the new wave of problems of the southern EU countries or the Chinese real estate crisis, which is predictable, but has not become a reality.

By the way, when it comes to the effects of free-market factors on real estate prices, with economic growth, and the responsibility of public authorities in mitigating the negative effects, China could be one of the best examples. We should only remember the warnings of prominent economists before the crisis of 2008, that one of the biggest risks to the global economy stems from the Chinese real estate sector. However, no matter how ironic it would be, China's real estate market not only failed to detonate before the recession, but also withstood the crisis. It perfectly supports the assumption that the responsible and prudent policies of the central bank and government decisions may manage the boom in real estate prices, making it similar to the real potential of the purchasing power of the economy and society, and not posing a danger.

Many economists and free market apologists are very critical of all decisions that reduce the value and attractiveness of properties believing it is an unreasonable interference in free market relations and an attempt to regulate prices artificially. These statements have some truth, therefore, when it comes to wise policy, raising prices (the real estate promoters are engaged in it, deliberately encouraging overly positive expectations) or price reduction should not be the goal. Decisions must be made in pursuit of the long-term goals.

For example, if the state is concerned about families and wants to prevent emigration, wants families to live in the country and raise children, with the growing real estate prices, it has to deal with the issue of housing affordability in one way or another. No less important is the choice of the elite in the country, of where to direct the public: towards creativity, or towards the accumulation of capital. It is very easy to identify this by looking at how labour and real estate is taxed. If society is oriented to creativity and increasing personal capacity, income generated from labour and business should be taxed less, and properties should be taxed more. Thus, the focus on the long-term interests of the state is often very clearly a background for certain decisions that do not allow real estate prices to rise above the real purchasing power of the public.

In this context, we have to recognize that, although after the crisis the Baltic countries realised that responsible policy is needed, so far, we can only talk about isolated decisions addressing the most significant problems, but there are no outlines of long-term policy, demonstrating the long-term perspective of real estate prices.

There is no doubt that in the next few years, the real estate market in the Baltic countries will rise and prices will increase, but whether it will be a long-term process that will continue with minimal downs for decades, or a phenomenon reminiscent of American roller coasters, will be shown by the objectives that dominate the agendas of the governments of the Baltic countries and the ways of achieving them. The fact that these objectives had to be set long ago is best demonstrated by the fact that in having a lot of negative influence on long-term real estate values, the demographic situation in the Baltic countries is deteriorating much faster than the purchasing power of the public is growing. So, if there is no wise policy, Parisian real estate prices in the Baltic countries will mean yet another bubble.

Excerpts from the article

There is no doubt that in the next few years, the real estate market in the Baltic countries will rise and prices will increase, but whether it will be a long-term process that will continue with minimal downs for decades, or a phenomenon reminiscent of American roller coasters, will be shown by the objectives that dominate the agendas of the governments of the Baltic countries and the ways of achieving them.

The explosion took place throughout all the Baltic states: the housing price index in the Baltic countries fell by almost half, from the highest price level during 2006-2007, to the bottom reached during 2009-2010. In Vilnius, apartment prices fell by about 40 percent, in Tallinn – 50 percent, and in Riga – by as much as 60 percent.

The rapid growth of real estate prices has a positive impact on the construction sector and the overall economy growth, so for politicians, it is often much easier to relax and enjoy a fast-growing economy, rather than making unpopular decisions restricting the availability of credit or the attractiveness of real estate investment by increasing the share of tax in the sector. So, the lack of social responsibility among politicians and business and ignoring the lessons learned by the Swedish were the main reasons why the real estate market downturn was so huge.

ARE THE SCANDINAVIANS PREPARING FOR ANOTHER BUBBLE BURST?

While real estate prices in the Baltic countries are stabilising and rising, Scandinavia is swelling up again – the International Monetary Fund (IMF) in its report released in August, highlights the precarious situation in the real estate market of Scandinavia, especially in Sweden and Norway. It states that Swedish real estate has been overrated by about 25 percent, and the Norwegian by as much as 40 percent. The truth is that they have talked about the potential burst of this bubble for several years, but up to IMF’s report, the banking stress tests have shown that they are capable of absorbing the potential problems of the real estate sector.

The fact that the tension in the Scandinavian real estate sector is seen seriously, and responsible preparations are being made to handle the potential risks, are obviously demonstrated by the decisions being made. Essentially after the end of the crisis of 2008, in particular, in March 2015 they made decisions further increasing the reliability of the bank. Moreover, Swedish Finance Minister, Anders Borg, predicts even greater regulatory tightening. Similar precautions were discussed in Norway. Such attention of responsible institutions on the real estate sector suggests that talking of a possible explosion of the bubble will remain nothing more but talking in the near future.

Diagrams

OBER-HAUS HOUSING PRICE INDEX IN THE BALTIC COUNTRIES (JANUARY 2004 = 100)

Source – Ober-Haus

CONSTRUCTION SCALE AND CHANGES IN THE BALTIC STATES, COMPARED TO LAST YEAR, MILLION EURO/PERCENT

Latvia

Estonia

Lithuania

Full-scale increase compared to the previous year

Source – Merko Ehitus

Lithuania, Latvia and Estonia trying to learn from B. Obama

by Karolis Makrickas, Baltic Economy journalist

There are fundamental foundations of the welfare state – gas, oil and other natural resources, demonstrating the country's economic potential and growth. What if there were no oil, gemstone mines or automotive concerns to focus on? What would show whether countries such as Lithuania, Latvia and Estonia will flourish in the next 10-15 years, and if the purchasing power of their populations will exceed the European average?

In comparing the U.S. and the European Union (EU) member states, we discover that the number of successful startups in the Old and the New continents differs greatly. After all, the establishment and setting up of young companies generating high added value is one of the indicators that shows further growth of the country's economic potential, the future value of real estate, etc.

While we recognise the resources and energy available to a country as fundamental prerequisites of a welfare state, it is important now that the situation is changing. The growing importance of technology companies and their ongoing research towards a country's economic development is well illustrated by the competition that has gone on for several years between the Apple information technology company and the oil giant, Exxon Mobil, for the title of the most valuable company in the U.S. and in the world.

The list of the most profitable companies includes Microsoft, Facebook, Amazon, eBay and many others which could have only been born in the United States. All of them were once startups. So it is no surprise that U.S. President Barack Obama invites the leaders of these companies for dinner at the White House, and discusses about how to increase the number of companies in the country creating high added value.

Although such a dinner party in 2011 could be considered a public relations campaign to promote the president, it, without a doubt, embodies the trend preferred by the U.S. – to strengthen the community of startups. After all, it is already the strongest in the world, and Silicon Valley is the best place in the world to start a business!

At the beginning of 2012, Obama solemnly signed the Jumpstart Our Business Startups Act (the JOBS Act), which emphasizes that small businesses and the presentation of young startup companies with experienced entrepreneurs and investors promotes the development of new jobs and plays an important role in strengthening the country's economic potential.

Another step in the U.S. is that the Senate is about to push the Startup Visa program, which will allow talented immigrants who have created a business in America to live there. The program developers have also emphasised that the program seeks to encourage U.S. competitiveness in the global economy.

Benefits of startups

Corporate giants such as Google say that startups fuel economic growth and increase innovation, while other information technology companies, such as Microsoft and Apple, are actively investing in startups or acquiring them, so it would be difficult not to notice their impact on the economy.

First, startups spend the money received from investors very quickly for office rent, staff salaries, legal advice and other services, and support the local community. According to various estimates, only 30-40 percent of funds in Europe are invested in startups by local businessmen, while other money comes from abroad. Therefore, the benefits are obvious.

Second, setting up new, high value-added companies is a source of creating better paid jobs, eventually allowing them to retain the most creative people, unlocking their potential and enhancing the national average wage. It is important for all countries that want their citizens to prosper and to stimulate economic growth, especially those who cannot boast of large corporations, such as Siemens, Samsung and GMC.

Different sides of Europe

How is the Spanish capital of Madrid different from Tel Aviv and London? Unfortunately, only London (7th place) and close to Europe Tel Aviv (2nd place) are among the best ten top startups. Other places in the top ten belong to the U.S. and Canadian cities.

The biggest concentration of startups is in the more or less European Silicon Valley in Tel Aviv. Another unique thing is that they do not apply an investment ceiling for startups, so even if you come up with a project costing a zillion dollars, you will be heard. The country has a very strong focus on research, and makes education a priority. So, it is no surprise that as many as 63 Israeli companies are included in the NASDAQ listing (more than Europe, Japan, South Korea, India and China put together!).

A complete opposite of Israel – Spain – cannot boast an abundance of startups (though it has excellent universities, and carries out a lot of EU funded research, etc.). Coincidence or not, Spain is in 136th place by rank in the number of new businesses created in the world out of 185 countries in 2013 (it is predicted to fall to 142nd place in 2014!). By comparison: Lithuania is 105, Latvia 59 and Estonia 50.

In 2013, Spain's unemployment rate for the first quarter was 27 percent. But unlike the U.S., when there are a growing number of startups in a deteriorating economic situation, the Spaniards do not engage in the development of new businesses. 100 Spanish entrepreneurs surveyed said the same thing – they blamed the government for the current situation, because not only does it not care about them, it also makes them feel like outcasts. Still, the Spanish government has already taken measures and is preparing an action plan similar to the U.S. JOBS Act to increase the number of new businesses in the country.

The differences between countries demonstrate how important it is to understand that the government of the country has to take care of tax, financial and other assistance in order for a competitive mindset to begin to flourish. Startups will not be born in a country if it does not pay sufficient attention to involving and supporting an educational system that produces engineers, mathematicians and IT professionals.

The individual focus of each EU member state on startups allows one to see and understand how much creative inspiration a country has, or whether conditions are favourable for implementing it. It is possible to distinguish between countries that are developing potential from those that have universities, research institutes and absorb EU funds, but basically rotate within the same economic potential which was created in the past and is more or less related to the development of intellectual potential (for example, newly found oil deposits).

Baltic countries

The Baltic countries have two leaders: Finland and Estonia. Once having been one of the top mobile phone manufacturers, being Nokia is no longer pleasing for the Finns. They find it strange that the once famous company, Rovio, developer of the Angry Birds game, has released it for other phones first. Therefore, a Slush conference is organized in Finland every year as compensation to help startups gain momentum. Its initiator is Rovio's marketing director, Peter Vesterbacka.

At the last Slush conference, Jyrki Katainen, the Finnish Prime Minister said: Many people say that the downfall of Nokia was the best thing that could happen to our country, because it will allow us to come up with new ways and means to ensure well-being, and it will be a basis to thrive on.” Some people even say that the current downfall of Nokia is the best thing that has happened to this country because it's challenged us to come up with new ways to create a foundation for our welfare. Katainen also vowed that the Finnish government would do everything to help startups, starting with tax cuts for business angels and venture capital funds, to capital allocation for technology centres.

Estonia boasts that it is the country with the highest number of startups in the world per capita. Everyone has heard of Skype, but here are some the country’s latest startup gems: TransferWise has attracted 6 million U.S. dollars in investment, and Fits.me, 7.6 million U.S. dollars. A total of 28.6 million U.S. dollars in venture capital was invested in Estonia last year.

Other Baltic countries are not doing so well. Lithuania can only boast of a few success stories: GetJar and Pixelmator. Latvia has its Latvian Mark Zuckerberg, Lauris Liberts, managing the Draugiem Group – the only social network in Europe that has withstood Facebook.

In assessing the current situation in the Baltic countries, it should be noted that Lithuania, Latvia and Estonia in particular, are quite successfully moving along the path in their promotion of startups and thereby enhancing their growth potential. Investors should take note of this, because if more startups grow within the next year, long-term positive developments will open up before our eyes that will have a significant impact on investment return.

Consider whether what U.S. President Obama is doing is a proper example that could be applied to other countries. Maybe the U.S. economy is not like the Greek economy only because it has chosen the path of developing startups. Are the countries that you want to invest in doing the same thing?

Article excerpt:

A study made in 2013 funded by the Kauffman Foundation reveals that from new jobs created every year, as many as 70 percent are created by companies that have been operating for less than a year. The Forrester Research study suggests that as many as 78 percent of small companies and startups believe that they will expand over the next two years, and as much as 39 percent of them hope to double the number of employees.

Energy from Renewable Resources Has Chilled, But Not the Climate

In a world where competition is more important than ecology, there is a question – what will happen faster: mankind will “eat up” the planet, exploiting its resources, or the planet will “rise” and natural disasters will make human existence insufferable? In view of the recent years’ trends, the last decade may be called a renewable-energy development era, whereas we are presently entering an era in which the fight against climate change will be dominated by costs. So, one should not be surprised when an announcement pops up that several new coal-fired power plants are being built in “green” Germany. To see why read the article.

Key words: Renewable resources, Climate change, EU climate policy, Green energy, Green energy equipment, New Great Flood.

We deliver, UAB is not responsible for advertisers content or information published graphical material Contacts: +370 (613) 87583, info@wedeliver.lt