The Mutating Vision of Kaliningrad: From Casinos to Iskander

by Vadim Volovoj, Baltic Economy Deputy Editor

The Russian exclave of Kaliningrad is an important part of the Baltic region that has substantial economic potential. In a 2013 the Russian edition of Forbes singled out Kaliningrad as the best place for business in a list of Russian cities. The region’s inhabitants and government want to use their economic opportunities and have more cooperation with their European neighbours, however the problem is that Kaliningrad (as almost all regions in Russia) is a political hostage of Russia. What exacerbates the problem even more is that the Kremlin doesn’t know itself what it wants to make of its exclave, whether it should be a successfully developing special economic zone, an area full of giant casinos, a regional centre for nuclear energy, a region that is a testing grounds for relations with Europe, or a military outpost that could be a threat to NATO and the European Union. The experiments Moscow has carried out on the Kaliningrad region is essentially a reflection of the unclear vision it has for Russia as a whole: Putin can’t make a decision whether it should be an economically vibrant and open country, or just one huge military base, which is the desire of supporters of a great Russian power. Kaliningrad is simply an unfortunate testing ground in all of this. .

Economic Successes and Hardships

In 1996, the Kaliningrad region was declared a Special Economic Zone. In 2006, the law was changed with a new one that is in effect until 2016. According to this legal act, a resident of the SEZ does not pay any income or property tax for the first six years, and for the next six years after this period pays only half of these taxes, depending on what their amount is in Russia. According to statistics from the Kaliningrad region’s government, eleven thousand new jobs were created, and investments were made in the range of 40.5 billion rubles. Until 2008 the economic development of the Kaliningrad region was quite successful – this is shown by the constantly rising direct foreign investment in the region’s economy (2005-2009 it amounted to $943 million, while in the future it should be further encouraged by Russian’s membership in the WTO, though its long-term effect on Kaliningrad’s economic development is unclear).

All of this confirms that Kaliningrad truly does have great economic potential, and that the 2008 slump should be looked at only as a temporary phenomenon (the gross regional domestic product grew 7.3 % in 2011, and another 3.6 % in 2012). However not all that glitters is gold: for example, a total of 164 companies went bankrupt in 2009, which is 12.3 % more than in 2008, with one of the more resonant cases of bankruptcy being the liquidation of regional airline company KD Avia. In order for the growth of the Kaliningrad region to stabilize and gain speed, its government has to work at it. This task, as experts says, is complicated by the new conditions (both before and after the crisis) of a clear economic strategy and lack if independence in the sphere of Moscow’s economic policy, not to mention the weakness of the transport ties with Russia proper. As Stanislav Voskresensky, who is Deputy Presidential Plenipotentiary Envoy to the Russian Northwestern Federal District, said in speaking about the Kaliningrad region, “according to unused potential, this territory perhaps occupies first place in the country. Europe is nearby, there’s access to the sea, the exclave’s location (there’s minuses, but also pluses). There is a regime of a special economic zone for business. At the same time local companies are living in conditions of fierce competition from the Baltic countries and Poland. Today the food products and health as well as educational services are cheaper and of higher quality there. And that is being with a transport system that is separated from Russia. This is why economic development must be supported by the creation of a better environment for business, investments and the creation of the quality appearance of new jobs so that the conditions foreseen for the special zone would start operating at full capacity.” At the same time, Voskresensky emphasize that “Kaliningrad is unique, and policy should be unique in its case, I am certain of that.”

Casinos, A Nuclear Power Plant and Corvettes for the Baltic Fleet

The economic expression of such a unique view became the decision of the Russian government to award Kaliningrad the status of a special gambling zone. However as Valery Ivanov, who is the council chairman of the Russian Association for Gaming Business Development, stated in 2010 that “up to this point there has been no shift in the Kaliningrad region. Serious – huge – investments are needed there. Which means long money. Investors are not ready and it’s doubtful whether they will decide to invest.” Experts from companies like Dress & Sommer, MCB and BRT believe that the American format of project implementation, which calls for building on a large plot of land “out in the open air”, as they are currently planning to do in the Kaliningrad region, is highly unlikely. According to them, in the case of Kaliningrad, they need to discuss the possibility of a “European” option, where the casinos work on the basis of an existing tourist infrastructure (first of all in luxurious hotels). However that is only in theory. In reality, the Kaliningrad region’s government was still looking for a plot of land for their gambling heaven in 2013 (the auctions that were organized did not provide any results), while in 2016-2018 they planned to invest 14 billion rubles into this idea according to a specific federal programme.

An example of the politically unique view toward Kaliningrad is embodied in the idea from Moscow that was born at the beginning of this century of the area as a testing region for relations with Europe. Putin developed the idea of having closer ties with the European Union, hoping for greater help from the EU in modernizing the region, which is why he attempted to build “bridges of friendship.” However the Kremlin was soon afraid of its own plans, as the inhabitants of the Kaliningrad area met this news with great enthusiasm and began to actively europeanize in both a social and economic sense. And though there were no clear traits that Kaliningrad smelled of separatism, Moscow decided not to risk anything. In this way, the pilot project finished without even being able to get off the ground. For example, today the Russian government is looking for a free visa regime with the entire European Union all once, instead of starting with the Kaliningrad area, which is harder to achieve, thus Vladimir Putin is more at ease.

Let’s go back to its strategic view toward Kaliningrad. One can say that after the rather unsuccessful experiments with the SEZ zone along with the gambling zone, the head of the Kremlin decided to take up what is dearest to him, which is energy. The concept of Russia as an energy superpower was born in his mind, which did not hope in friendly relations with its neighbours, but be able to demand it. At one point it seemed that Moscow wanted to turn Kaliningrad into a regional centre for nuclear energy. There were efforts to build a powerful Baltic nuclear power plant (with an overall strength of 2300 MW) in Kaliningrad, which would have produced too much electricity for the district itself. A greater part of local and foreign experts were unanimous in saying that it was more of a geopolitical project than an economic one, the goal of which was to export Russian electricity to neighbouring countries that in this way solidify the influence of Russian energy (and along with it, its politics) in the Baltic region. In this context, there was a desire to lay an electricity bridge to Poland and through it to the Western Europe market (first and foremost that of Germany), and perhaps lay a direct electric cable to Germany and turn Lithuania into the junction for the distribution of electricity made in the Baltic’s nuclear power plant (the Visaginas nuclear power plant that the Baltic countries planned in this case would be then rendered moot). However Warsaw, Berlin, Vilnius and various international investors that were actively encouraged by Russia to take part in the building of the nuclear power plant viewed Moscow’s intentions rather sceptically, which forced Russia to re-look at their initial plans. It is likely that there will be further attempts to implement the Baltic nuclear power plant project in 2014 (as Russia is able to financially support their own nuclear power industry with such projects): first of all efforts will be made to convince the neighbours of the Kaliningrad region of its pluses and necessity for the expansion of electricity connection (after all, the Baltic’s nuclear power plant needs back-up capacity and a market) to neighbouring countries. However whether or not this power plant will be built first of all depends on how neighbouring countries and the EU will succeed in carrying out their energy strategy, the goal of which is the integration of the European energy market and the lessening of its dependence on Russia.

In other words, Putin’s nuclear strategy in Kaliningrad essentially was unsuccessful, and now it seems that he decided to return to an old but trusted method – to turn Kaliningrad into a Russian military outpost that could be a threat to NATO and the EU, which gets the hearts of the brainwashed neo-imperialists longing for old Soviet times to beat ever faster and support their president. The argument is that it’s necessary to have an answer to the West’s plans to have an anti-missile defence system in the area. To show that this is not empty talk is proved by the facts that confirm that recently Moscow has strengthened the military might of its exclave: the Baltic Fleet has received modern war ships, strengthened their air force, while the region now has the S-400, one of the best anti-aircraft and anti-missile defence systems in the world, the range of which (up to 400 km) allows them to control a large part of the air space of the Baltic region. It also possesses a powerful Voronezh radar system, the range of which is from 4000 km to 6000 km, plus there is still talk about the deployment of the mobile theatre ballistic missile system Iskander, which can be armed with nuclear warheads. What’s more, as was shown by the Zapad-2013 joint military exercises of Russia and Belarus, Kaliningrad together with Belarus hold a special place in Moscow’s defence (or perhaps attack) strategy in the Baltic.

In short, one can say that the militarization of the Kaliningrad region as a priority option in its development is rather short-sighted, because the growth of its economic potential seems to have much better prospects, and more effective by implementing things like the Special Economic Zones. In the latter case, the Kaliningrad region could become not only attractive for Russian investment, but also foreign investment (especially from the countries of the Baltic region), but as a political hostage of an undecided Moscow in the broader sense, it can only hope for a more sober view by Putin at this Russian exclave that has great economic prospects.

Quotes

Recently Moscow has strengthened the military might of its exclave: the Baltic Fleet has received modern war ships, strengthened their air force, while the region now has the S-400, one of the best anti-aircraft and anti-missile defence systems in the world, the range of which (up to 400 km) allows them to control a large part of the air space of the Baltic region. It also possesses a powerful Voronezh radar system, the range of which is from 4000 km to 6000 km, plus there is still talk about the deployment of the mobile theatre ballistic missile system Iskander, which can be armed with nuclear warheads.

An example of the politically unique view toward Kaliningrad is embodied in the idea from Moscow that was born at the beginning of this century of the area as a testing region for relations with Europe. However the Kremlin was soon afraid of its own plans, as the inhabitants of the Kaliningrad area met this news with great enthusiasm and began to actively europeanize in both a social and economic sense.

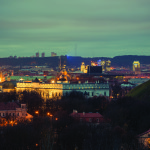

Vilnius – Esteemed by Investors, Open to Investors

EUR 76 billion is the total annual turnover of the companies investing in Vilnius. That's seven times Lithuania's yearly national budget. Dozens of companies (including Western Union, Barclays, etc.) have already recognized the investment potential of Vilnius, its favourable investment environment and the payback of investments in the capital of Lithuania. Want to know why Vilnius is so attractive for investors and what is its future investment potential? Read the article and find more information about prospects for business tourism in Baltic states in the other two Baltic Economy articles - „Prospects for Business Tourism in Vilnius“ and „Business Trips to the Baltic Countries: Two Birds With One Stone“.

Key words: Vilnius investment, Arturas Zuokas, Vilnius projects, Business tourism in Vilnius, Western Union, Barclays, IKEA

Lithuania Builds New EU–China Transport Corridor

by Arunas Spraunius, Baltic Economy journalist

According to the data published by Eurostat (as of 13 Feb 2012) the export of the 27 European Union (EU) member states to China increased by 21 percent during the first ten months of 2011, compared with the same period of the previous year while import of goods from China to EU increased by 5 percent. As reported by China Customs, the turnover between trade partners reached 567.2 billion dollars throughout the 2011 and rose by 18.3 percent in comparison with 2010. China is second-largest EU trading partner behind the USA while the EU itself is the top partner of dynamically rising Southeast Asian powers and important supplier of advanced technologies.

Competition and Cooperation on the Eastern Coast of the Baltic Sea

As anticipated, intense competition for at least some of East-to-West and West-to-East cargo flows is taking place within the EU as well as with third countries. According to Andrius Šniuolis, head of Water and Railway Transport Policy Department of the Ministry of Transport and Communications of the Republic of Lithuania, Asian market of cargo transportation is immense, so it is understandable that every country, not just the EU, tries to get a portion of it. Therefore, no illusions should be entertained – competition between Baltic countries in this situation will only intensify.

Marius Matulaitis, Deputy Director of Market Research and Development Department of Cargo Transportation Directorate of state-owned railway operator "Lietuvos Geležinkeliai" (Lithuanian Railways) agrees with that, too. According to him, Lithuania competes against its Baltic sisters in cargo transportation sector, however, this competition for it isn’t well-proportioned due to the fact that it can take advantage of only one seaport, whereas its neighbours (Latvia in particular) – of more. Therefore, let us say Latvia can attract to one of its ports a business structure as a shareholder to construct a terminal, which will ensure cargo flows, as well.

Another field of competition, this time in the railway transportation corridors, lies between Belarus Brest (to Poland) and Lithuanian Šeštokai (also to the neighbouring country). This competition poses considerable difficulty for Lithuania as Warsaw can freely choose priorities and means of implementation of its transport policy (direct the freight via Belarus, as well as Lithuania). However, Vilnius doesn’t possess such a room of manoeuvre.

Nonetheless, state-owned railway operator Lithuanian Railways carry on railway projects. "Šeštokai Express", to name one of them, aims to direct the freight from Warsaw through Vilnius to Smolensk, where it is distributed to further destinations.

On the other hand, aside from the competition in certain spheres the Baltics seek pragmatic adjustment of their interests. As an illustration, Baltic States jointly work on equal freight transportation issues employing so-called container trains (Latvians have "Zubrus" carrier while Lithuanians operate "Vikingas", also "Saulė" is gradually being launched). Also, steps are made to resolve tax tariff concerns. In the meantime, a joint Lithuanian and Latvian task force is being established, which besides other matters will discuss and accommodate pragmatic railway transportation interests.

Seeking to take full advantage of opportunities presented by the "East–West" transport corridor, Lithuania should improve its infrastructure in the sector Klaipeda–Vilnius–Belarus border. In addition to already elongated railway stations, (which are now capable of receiving longer trains) it is essential to lay secondary tracks and encourage more intense locomotion in both directions. By the way, China is also trying to get access to longer and heavier trains that are capable of carrying not just 6 000 tons as of now, but 7, 8 and even more thousand of tons.

The most expensive way of transferring cargo is by air transport, second, in terms of cost, is the railway and the cheapest solution happen to be the marine transport. Obviously, the price is heavily corrected by the existing infrastructure. The majority of freights from Southeast Asia are carried by sea transport, however, it takes time to circumnavigate Africa and pass the Suez Canal. The task confronting any railway company is to build a kind of infrastructure capable of competing with the sea transport. It is sought to adjust railway routes because these provide twice as fast delivery at a competitive price. However, Russia is a factor that has to be taken into consideration as it interferes between pragmatic China and Kazakhstan. Russia's decisions regarding freight transportation are often politicised and not necessarily based on economic considerations.

Moscow does not confine itself to merely economical means in pursue to conduct cargo flows to its rapidly developing sea ports, like Ust-Luga. The port’s capacity is being expanded to 180 million tons per year (in comparison, Klaipeda port currently loads 36–37 million tons, and even after maximal deepening and reconstruction of the quay the new territory and infrastructure will boost its capacity just to 65 million tons). Russian authorities allocate massive investments to expand their ports and related infrastructure.

Investments into Railways and Port

Since time is a key factor in freight transportation business, smooth cooperation between the airport and railway is essential. State-owned railway operator "Lietuvos Geležinkeliai" (Lithuanian Railways) and state enterprise "Klaipėdos valstybinio jūrų uosto direkcija" (Klaipeda State Seaport Authority) join efforts in the shared infrastructure projects and such cooperation intensifies. A balanced development of both sectors is being sought. The importance of these sectors is recognized by the state, too as railway and sea transport at the Ministry of Transport and Communications is supervised by the same Water and Railway Transport Policy Department.

A lot of money has been invested into Klaipeda seaport as well as country’s railway development over the last seven years. The new EU financial prospects for the years 2014–2020 intend new investments, for example, to allow mooring of larger vessels. Currently, different scenarios of port extension are being considered (specific details should show up at the beginning of the next year). Upon realization (it is anticipated to occur after 2020), the port capacity could reach 100 million tons.

The state railway operator Lithuanian Railways invested about 700 million litas into infrastructure in 2012. At the start of this year, the company developed and presented its strategic development project up to the year 2030. This time limit is chosen because of slow momentum typical to the railway industry as a whole due to its long rolling-stock service duration, long lasting implementation of infrastructure projects and slow investment absorption. The strategic transport corridor Kena–Klaipeda is planned to be a two-way road capable of transferring 85 million tons of cargo per year. Klaipeda will extend itself by building new stations: "Draugystė", "Pauostis" and "Rimkai".

By transporting freight via the "East–West" corridor Lithuanian Railways earns its basic income (70 %) and competes with Latvian, Estonian, Russian, Ukrainian and Polish ports, also with Belarus Brest transport corridor. Although working in harsh conditions of competition, according to "Railway statistics" of 2009, Lithuanian Railways still transported less than Italy, UK, Austria but outpaced Romania, Czech Republic, Turkey, Spain, Denmark and Belgium. Due to environmental considerations EU plans to carry at least half of the load by railways and Lithuania already does this. The strategy up to the year 2030 aims to preserve traditional freight market share and seeks to improve cargo handling from Asia.

In 2001, Klaipeda port has reloaded 17.2 million tonnes of cargo and 36.6 million tonnes in 2011, which are even 19.4 million tonnes more. This was strongly influenced by investments – Klaipeda State Seaport Authority invested into port infrastructure about 1.34 billion litas, while companies operating in the port, twice more. In 2013–2015, investments are expected to reach 467 million litas. The new investments will allow integration into European transportation networks and establishment of a sea highway system.

In the wake of dredging operations Klaipeda port has widened to 150 metres and deepened to 14.5 metres. The port is now capable of receiving the so-called "Post-Panamax" class of ships that are 300–310 meters long and 40 meters wide. One more project being implemented is Container Distribution Centre (so-called "Klaipėdos Smeltė" HUB). Upon its completion, "Klaipėdos Smeltė" has a potential to increase the volume of containers transfer over the decade to up to a million per year.

The bulk cargo distribution centre ("Bega" HUB) operates from the 13 of June, 2013. The Company runs a universal agribulk export and import terminal here suited for all types of agricultural products: corn, various extruded products, rough milling grain, granules, of raw sugar, etc. In technical terms, terminal is capable of both import and export operations, its capacity and technical potential also allow receiving the "Post-Panamax" class of ships.

Container trains as a counterbalance to "political cargo"

The so-called intermodal transportation model equips businesses with a fast and efficient freight transportation means not only to neighbouring countries, but also to more distant economies. One of such container trains "Vikingas" has been put into service in 2003, in Lithuania. This project links the Baltic Sea and the Black Sea regions. A lot of efforts are applied to include Sweden into it; cooperation with the country's national railway carrier is being conducted. For example, talks regarding harmonisation of transportation conditions for component parts to one of the giants of passenger car assembly plants in China are being held. In case of success, the component parts would be carried from Karlshamn in Sweden to Klaipeda port and then, by "Vikingas" would move further to Belarus, where the train connected to another one, would be transported to China once a week.

In the realization of another project "Saulė", the first 42 containers packed with computer hardware have been shipped from China to the port of Antwerp via Šeštokai station. A reverse transportation test also carried out from Klaipeda to China, which took just 11 days. Although the project cost is not terribly competitive, it is still pursued; every month partially filled containers from Klaipeda are heading to China. Lithuanian Railways view this route as a prospective one, particularly in the light of China's plans to develop industry in its western region. This is typical in cargo carrying business – container train "Vikingas" has been running already for more than ten years and is still expanding its geography and attracting new countries.

In 2013, the first container train "Baltijos vėjas" departed from Vilnius Paneriai railway station to Kostanay town in Kazakhstan. The train will transport cargo by this route twice a month and will reach its final destination in a week. The expected volume of each train is up to 120 TEU’s. The train is operated by Vilnius company "Hoptrans Projects". The project implementation is contributed by companies "Transkonteiner", "Autoverslas", "Kedentransservis", "Unico Logistics" and Lithuanian Railways.

The importance of the project is determined by the direction of cargo flow from West to East. Up to now the majority of railway freight in Lithuania flew from East to West. "We intend to carry about 80 containers every month by the train "Baltijos vėjas"," said Valdemaras Zakarauskas, CEO of Lithuanian logistics company "Autoverslas". "We have a long term contracts with car parts suppliers, so we deliver car bodywork, assemblies and component parts to Kazakhstan. It is extremely difficult to predict the arrival time if cargoes are shipped in a single railcar."

Mr Matulaitis claimed that implementation of the container train projects for Lithuanian Railways is also vital in the sense that this is a counterbalance to so-called "political cargo" (such as oil, fertilisers); although these make up the bulk share of the transported freight (the biggest competitor in this segment is Latvia). In fact, container trains constitute only 5% of all carried cargo.

Representatives of the Chinese Business would not take seriously talks that Lithuanians alone could transport the commodities from China to Europe. Even if Lithuania managed to "snatch" just one percent of this volume, Lithuanian Railways and Klaipeda port would probably not be able to service it. That is why Lithuanian Railways hold talks with their counterparts from China neighbouring Kazakhstan on establishing a joint venture. Discussions are not confined just to cargo carrying issues alone, but also involve the establishment of public logistics centres in Kazakhstan. Such centres could service the container trains coming not only from China, but from the entire Southeast Asia. The cargo would flow to the already being built logistics centres in Vilnius, Kaunas and Klaipeda, reloaded here and transported further to the West via Klaipeda seaport or Polish railway.

Fervour for Public Logistics Centres

Implementation of projects for the establishment of public logistics centres started in 2008 in Vilnius and Kaunas while Klaipeda joined them in 2012. According to estimates of the Lithuanian Railway specialists, such centres will save time (from current 40 to 7–8 hours), that is still taking containers to be dispatched from the seaport by the railway.

The most advanced of all projects is about 360 hectares Vilnius logistics hub near Vaidotai railway station, which is planned to be included into the terminal. The future plans envision building Vilnius roundabout at the terminal, thus ensuring egress to the motorways in the direction of Minsk and Klaipeda. The mandatory requirement for terminal is to be surrounded by transportation and logistics businesses nurturing it with cargo flows. That is why Lithuanian Railways and Vilnius municipality established in 2011 public organization called "Vilniaus logistikos parkas" (Vilnius logistics park), whose purpose is to develop infrastructure and to map land lots around the intermodal terminal. Four land lots are already mapped and offered to potential investors.

The project of Kaunas public logistics centre is linked with the "Rail Baltica" project. The terminal will feature two types of railway track gauge – European and Russian and will boast super fast cargo reloading procedure from one type of railcar to another, also to automotive transport. According to the representative of the "Rail Baltica" project, Domas Jurevičius, the planning stage of European type of railway track gauge is finished from the Polish border to Kaunas and construction works that have started in this sector should be finished at the end of 2015. The European track gauge building is taking place in Lithuania only – neither Latvia nor Estonia has set to work yet.

A lot of discussions draw High Speed Train track construction between Kaunas and Tallinn where trains could be capable of reaching 240 kilometres per hour speeds. Transport ministers of the Baltics have signed a joint statement regarding this issue; so far, this is yet the initial stage at which matters of establishing of a joint venture are discussed. By the 15 of November a specific assessment of impact on environment had been performed, that had to clarify the dilemma of the line route via Panevėžys vs Šiauliai.

European railway track gauge from the Polish border to Kaunas may actualise the North-to-South (Poland–Finland) passage as well as the East-to-West direction in a sense that the cargo reloaded in Kaunas public logistics hub could be transported further to the West via Poland not only through Klaipeda port, but also by the railway. By the way, there are plans to implement the project "The Eighth Corridor", which would connect Belgium, The Netherlands, Germany, Poland and Lithuania.

In reality, taking an advantage of the potential or failing to do so will be decided by various factors – cargo transportation tax rates, cargo volumes and carrying capacity. In Poland, for example, an outdated infrastructure prevents trains from putting on higher speeds. Polish government promises reconstruction of the track width by the year 2024 (by then the high speed train line Kaunas–Tallinn should be launched) permitting to put on speeds up to 160 kph. Poland has actually started reconstruction of the track in certain strips; therefore, it is likely that these pledges will be fulfilled. This would suffice that freight moves smoothly to Western Europe.

Potential is Seen by Everyone

The cargo flows in the direction from the EU to China are still obviously weaker than the opposite China–EU direction, also due to the different levels in development of the parties. Up to the recent time Chinese could not afford purchasing goods "made in Europe". Actually, the Chinese get richer, their middle class increases, thus the country is trying to get rid of the "world factory’" reputation and move on to manufacturing that would be more complex and requiring more expensive technologies. As a result, the Western brands gradually become more attractive to the Chinese. By the way, Scandinavian countries are particularly interested in Chinese market.

As regards competition between the various cargo transportation types from China to the EU (and vice versa), it should be worth noted that it is considerably segmented. Suppose, that the products that should be instantly delivered (such as clothing – China is known as speedy manufacturer and distributor of famous and fashion brands) are transported by aircraft. The vast majority of other commodities are being transported by ships. In regard to railways, projects begin to evolve, including the transnational ones. For example, "Russian Railways" and German company "DB Schenker" have established a joint venture, which carries cargo from China to Western Europe by container trains.

According to M. Matulaitis, this is the mere beginning yet. One of the reasons is that transportation of cargo by railways across China (including third countries) to Europe is too expensive. The Chinese industry just a while ago started to move from its eastern part which is rather urbanised to the western part that is closer to the EU and, therefore, larger quantities of Chinese commodities that will be transported by railways can be expected approximately in five years. Moreover, the Chinese have strong freight shipping companies (such as "Cosco" which is one of the largest in the world) that would not be happy if railways took over their cargo (or part of it).

During the Asian and European "ASEM Transport Ministers’ Meeting 2009" that was held in Vilnius in October 2009, Lithuanian Transport minister Eligijus Masiulis declared that Lithuania wanted to become a bridge between Asia and Europe. At that meeting, the Vilnius declaration was signed. The document states that closer cooperation between Asia and Europe should be encouraged. Almost at the same time, in the capital of Lithuania the Asian and European transport development forum took place. During the closing conference the China's transport minister Lee Shenglin emphasised that his country was ready to solve the transportation problems actively because it was interested in easier and faster movement of the cargo between China and the EU.

The priority of the European Commission (EC) is to provide environment-friendly, clean transport, and railway belongs to such type of transport. This means greater investment into this sector on a scale of the entire Old Continent. The EC also works on the transport corridors aiming to connect them with the transport networks of so-called third countries (Russia, Belarus, Kazakhstan etc.). The EU cannot make direct investments, let us say, into railway construction somewhere in Belarus, Russia or Kazakhstan. However, the EC can initiate a preparation of a feasibility study of this subject. No doubt, this is crucial in order to take advantage of the cargo flows in the East–West and West–East directions. Also, a joint China and EU work group has been established. Transport issues received a lot of attention in its agenda.

Of course, the business assesses and calculates financial expenses and time ratio and makes its own choice what type of transport – sea, land or their combination – to choose from. Anyway, this discussion is more about the prospects, although initial steps that have been taken already. For example, the project "Saulė" is widely supported by Kazakhstan. There is no shortage of preparatory works, in particular development of infrastructure; however, the potential is seen by all participants.

Notes:

Warsaw can freely choose priorities and means of its transport policy (to direct cargoes through Belarus, as well as through Lithuania); however, Vilnius doesn’t possess such a room of manoeuvre.

Moscow seeks to direct cargo flows to its rapidly developing seaports, such as Ust-Luga, resorting not only to economic measures.

In the wake of implementation of the project "Saulė", the first 42 containers with computer hardware have been delivered to the port of Antwerp via Šeštokai railway station.

Plans are being designed to implement the project "The Eighth Corridor", which will link up Belgium, the Netherlands, Germany, Poland and Lithuania.

LNG Carrier – Floating Lithuanian Fortress on the Baltic Sea

by Povilas Juodelis, Baltic Economy journalist

In December 2014, a liquefied natural gas (LNG) terminal project of a kind unlike any other before in Lithuania or the Baltic region will be launched in Klaipeda Seaport. This highly important strategic project aspires to change the economic map of the Baltic and Nordic countries. You want to know how – read the article.

Key word: LNG, LNG carrier, Lithuanian LNG terminal, Klaipeda seaport, Polish LNG terminal, Baltic LNG, Small states geopolitics, Lithuania regional leadership, Lithuania energy independence, Gazprom.

Scandinavian Investments in the Baltic States – Risks and Opportunities

It was just last year that the Norwegian company "Reitan Convenience" acquired "Lietuvos spauda" ("Lithuanian Press"). Lessons of the recession, Norwegians' determination to invest in the Baltic States and business challenges are related here by Mr. Rens Razums, General Director of "Reitan Convenience Lithuania" and Business Development Executive of "Narvesen Baltija".

For both the Scandinavian and Baltic business communities, the crisis was a very good learning opportunity, though harsh and expensive. It has taken a lot of “foam” away, but those companies that are here with long term plans are staying and expanding.

Certainly there are several sectors that probably will never be as vibrant as before, namely real estate with a tough market, its sluggish growth of a customer base and high development prices, or the media sector. In the media, I would guess Scandinavian companies are facing tremendous challenges and/or opportunities at home, i.e. issues with the decrease in the print media or the TV vs. Internet shift, so cutting “loose ends” is inevitable.

But I am sure that other sectors like production or agriculture are becoming more interesting. And what is also important, there are more and more local players that are not just seeking money or advice, but are ready and willing to talk with Scandinavians as equal partners.

I think the Baltic countries are in a very good position economically. Just think about being located in between the European powerhouse of Germany, the most prosperous part of Europe – Scandinavia on one side and fast growing economies like Poland and Russia on the other side!

But there are few challenges, namely the shrinking population and the fact that our politicians do not understand the concept of competitiveness. Why are we experiencing such an exodus of population? It’s because other countries have been better at selling their image, dream or social model, and active people have chosen their offer! Many politicians still think they are sitting on “golden eggs”, although it is far from that. Every European country is competing for money, the best people and the best ideas. So what are our competitive advantages, really?

I think there are few differences in business culture in the Baltic capitals. We recently discussed customer habits with a lady from Lithuania and as she said, the retail customers in Tallinn and Vilnius are more similar than in Vilnius and Marijampole, for example. And I think the same can be said about the business culture. This is because in the Baltics, I think we are very quick to adapt. Also, historically, we have lots in common with Scandinavia (small nations, German (in the background) and English–language influence, societies rather open to foreign influence, historical gender equality (compared to other parts of the world), etc. However, there are still areas I feel we are lagging behind in general – we are much less outspoken (afraid to criticize our bosses and leaders) and less sensitive to human capital. Therefore, I believe that Scandinavian investments bring a part of their own business culture here and I think we should be very happy about their vast presence in the Baltics. However, we are more passionate about what we are doing and that is a positive trend when looking to the future.

The Way to Win – You Have to Be the Largest

In the opinion of our editorial office, Hans H. Luik is a businessman that works in a particularly competitive and often problematic Baltic media market, which a host of famous media concerns have left, and has been able to not only survive, but be a leader. We chose him for an interview about economic trends and prospects on business expansion in the region because the media branches he leads demonstrate a rare high-level professionalism and objectivism.

The first thing that I would like to ask you would be your understanding of what happened in Latvia, Estonia and Lithuania after the crisis period. Could you say that these countries started to act differently and that the Baltic countries became a better place for doing business?

I think that all the free countries were very happy to join the European Union, and those European funds were vital for the Baltic countries. I also think that we became better at bookkeeping, and at least the Estonian government is now much better at giving subsidies to economic sectors which are in real need of them. The governments became more electronically-based, and there is much more analysis, and I even think that the tax systems, especially the very hard bit which Mr. Kubilius’ government had to give the Lithuanians, were worthwhile. I think that otherwise, if we had heavier tax burdens, if we were taxing more profits, the shadow economy would be much higher, but we ended up not having a large shadow economy. Now governments are collecting taxes. It could be worse. At the same time, the hit that the private industries took was hard. Private industries had a heavy tax burden. And these industries still have a long way to go to clear off their balance sheets, including my company the Ekspress Grupp.

When talking about the future of these economies in the upcoming 5 years, what would your forecast be: will it be bright or will it be cloudy?

Well, if I am talking about the economic area which I am quite familiar with, the media and printing industry, I think that there are bad signs. For example, the most technologically advanced media company of Scandinavia, namely Schibsted from Norway, sold their assets in the Baltic countries. They took a loss, and this is a sign that they thought that they will not be able to do profitable business here. Secondly, some years ago Bonnier, which is a mighty publishing company from Sweden, sold their assets in Riga. The best and widest Latvian newspaper was sold to local oligarchs. The third thing is that the “Murdoch” TV station was sold in Latvia. It ceased to exist.

I feel that in terms of big business our Baltic states are not doing well, and the reason why we are not doing well is the demographic situation, with a steady decrease of the core population. Therefore those markets do not seem to be attractive anymore. And not only in media sector: international French giant Dalkia disinvested from Estonian monopoly “Tallin Heating”. At the same time Sanoma Group divested of Estonian chain of bookstores “Apollo”. I think the biggest Finnish group is going to leave the Baltic states altogether.

Our governments seem to ignore the fact that we have to encourage people to stay in Latvia, Estonia and Lithuania instead of playing a liberal market economy and letting them go. They should be doing much more. It is especially relevant to Lithuania because it is very hard to get its population to return. With Estonia it is slightly better, because most Estonians just go to Finland, which is 80km away. They might return if they choose to. I think the governments would have to take the initiative, take loans and invest in jobs for especially young people to get introduced to companies and perspective jobs. And I also think that the business section should help young people to get practice in the companies, factories, and offices which we have. I am ready to do this. I am giving young people insight to our company, particularly giving it to students.

Also, if these countries are going to be attractive to foreign capital, which you are asking about, they need to free up their immigration policies. Up to now the situation in these countries, even though there is a change in legislation in Estonia right now, is such that they are forcing foreign students who have completed their studies to leave within a couple of months, which is a silly thing to do. Those are people who have been satisfied with the environment that we have in the Baltics, with the levels of your institutes and universities. Why would we force them to leave the country instead of finding a partner, marrying and getting a job? So immigration and demographic policies would have to be altered in Baltic countries for them to become attractive.

We both understand that we are a small market, so it is very difficult to explain why somebody has to care about us, but when we are talking about the period before the crisis we can say that Scandinavian companies were investing much more than they are investing now. However, I am thinking that now we have more order, as you mentioned, in all areas of finances of government policies. We now also know that in the upcoming 3-5 years the Baltic countries will have one of quickest growth spurts in Europe. In my opinion, it is very strange why as we were bubbling someone was investing very quickly, but currently everybody is waiting for something.

I think that the cause might be that now the big Scandinavian countries as well as central European countries are having difficulties themselves. They don’t have excessive capital and the banks would not support investment. Nordic companies normally work hand in hand with their banks, and if they extend their activities the bank also extends the loan. Now I think that everybody is very conscious under these economic circumstances. Finland has negative growth. Sweden is announcing some problems. At the same time I see agriculture as being very interesting. We have a big Russian investor who is consolidating Latvian agriculture in arable land. We have big Austrian companies doing the same thing in Estonia. I don’t know about Lithuania, but there was a big Turkish green agriculture product company in Estonia, wishing to either buy or rent 1000 hectares. “Everybody wants to buy now”, they were told and they stepped back. So some particular areas have foreign investment.

Speaking of growth, we can see an example such as Ikea and their partners from Lithuania, which are now building factories in Belarus and producing furniture for Ikea. And when we talk about media business or other business that you are familiar with, can you see the same trend: investing in the Baltic countries and from there moving to the east – to Belarus, Ukraine, Kaliningrad, Russia. Does this kind of direction exist?

Yes. Estonia has been like this all the time. I think that ABB has been doing this and also the great brewery system which has Aldaris, Saku and Baltika - they were investing in the Baltic states and then they made a jump to Ukraine and so on. This has been happening the whole time. At the same time I think there is a tendency which I observed aside from the media. We saw the big French international infrastructure company Dalkia leaving Estonia, leaving the provision of Tallinn’s central heating to their local Estonian partner, which is very exceptional. We saw the big cinema company Finkino leaving the Baltics and selling their operations to the local management. When times are bad and the foreign companies choose to leave, a huge potential appears for locals to gain shareholdings in their local companies.

You see many problems, including demographic problems, but you are still thinking of expanding your business by acquiring some extra facilities.

You have to be the largest in order to attract customers and advertisers, especially in media. This is our strategy and we have been sticking to it. Delfi is the largest information portal in the 3 Baltic countries. We have been acquiring companies all the time. While building our portal we as well as our competitors have been purchasing different advertising systems, different small niche portals, like Portal 4 for young mothers.

Again let me ask you: when talking about the business of investing in the Baltics and from the Baltics to other areas, what is your opinion about investing in Ukraine and Belarus? And secondly, what do you think about investing in Scandinavia itself?

We are doing a lot of export. Our printing operation is doing a lot of business with Scandinavian customers, so Scandinavia is a market which we know pretty well. I have done a lot of investing in Ukraine. Delfi is working in Ukraine. We set up advertising and media agencies with Agecom, which I started with my colleagues years ago, and we also set up a telephone information service in Warsaw. So I have been quite busy as you can see, but due to the rough current situation I don’t think that we accumulated enough capital now, but maybe if banks come to help and a good opportunity arises we could do it. We also have been looking recently into Polish investment opportunities in the internet. At the same time my companies and other Baltic investors are far from being satisfied with legal atmosphere in Ukraine: it happens that Ukrainian court looks like a business as any other.

When we talk about the differences in the markets what, could you say about the difference between Lithuania, Latvia and Ukraine?

Well, Ukraine is very specific. I think that in the Ukraine, the internet is not doing well and advertising systems have not fully formed yet. The advertising market is still full of opportunities, but there are too many middlemen. So it might be that instead of finding the right channel the advertiser goes to the direction that the middleman wants the advertiser to go. Middlemen have too much power in the Ukrainian advertising business.

You mentioned that currently your opinion is that Scandinavia is withdrawing some of their investments because they are having difficulties themselves. Do you think that such an attitude towards the investments will remain the same in the upcoming few years or will it change, if the data is going to show a steady 3-4% growth during the upcoming period?

I am a little bit pessimistic about this. We might look forward to the end of international crisis, but the problem remains that the euro zone is lacking confidence and if the euro zone can’t realize its united banking inspection, then there will be no confidence in European Union. What is actually happening in Spanish and Greek balance sheets? Nobody knows. Therefore there has to be bank inspection, but the effects remain to be seen. If they can’t put their banks in order no one will trust Europe and the recession will be prolonged. Middle class is experiencing hard times everywhere in Europe, except Germany. We will see competing economies such as China and the USA rising, and now we must find our own way.

Why Do the Vikings Resemble Draculas?

The answer is simple – because, when trying to conquer or having conquered a certain market segment in the Baltic States, Scandinavian businessmen are concentrating with great zeal on those solutions which allow them to generate income, but ignore the systemic faults which over time affect their own business as well. Due to this reason, a certain portion of the representatives of Scandinavian business not only does not lend a helping hand in improving the system within which they are operating, but, being led by their own trifle interests, they are even impoverishing it more, and eventually the accumulating systemic problems turn back against the Scandinavian businessmen themselves. Therefore, Scandinavian concerns that publish daily newspapers, which did nothing towards a more transparent Baltic media market, are silently retreating. In their own turn, Scandinavian pension funds, which have adopted a passive standpoint in respect to the necessary systemic reforms in this field, are only concerned that in the Baltic States' pension systems, which are submerged in the swamp of negative demographic trends, there would appear some money that could be snatched up right away.

However, opting out from solving systemic problems and concentrating on one's own narrow interests are not sufficient grounds for the Vikings to be dubbed Draculas, since such a short-sighted attitude is also typical of the majority of other investors. The image of Dracula is imparted upon their pension funds not so much by their efforts to extract as large a share of money as possible from the crumbling social system, but rather by what is being done with this money later on. Pension funds that reside in Scandinavian countries invest the major portion of the collected money in one way or another domestically. Meanwhile, Scandinavian funds' branches operating in the Baltic States invest in the latter considerably less, and in the Baltic stock market – practically nothing. Consequently, it is much more difficult for Estonian, Latvian and Lithuanian businessmen than for Scandinavians to attract money and to develop or acquire a business inside their countries. This moment is one of the most crucial in explaining why the Baltic States' businessmen very often regard pension funds only as instruments of generating profits for the aliens, which are enhancing the economic and investment potential not of their own country, but of those countries to which the business belongs. Not much of a more amicable attitude is emanating from the working people who, unlike in Scandinavian countries, do not see in the least way, any closer connection between the money accumulated in the funds and the economic welfare of their country and enterprises where they work.

A somewhat more amicable attitude towards Scandinavian pension funds is emanating from the Baltic States' future pensioners, but they also understand that something is wrong, since in the meantime, when money keeps being transferred to pension funds, the state pension system's debts, at least in Lithuania, already reached 10.5 billion Litas in July, 2013. At the same time, it must be remembered that in Lithuania, taxes designated for retirement security, which are levied on the employee's income, are one of the highest in all of Europe, whereas the demographic-situation forecasts are one of the poorest. For this reason, our editorial desk's journalists have already tried more than once to draw the government's and market players' attention to the fact that without systemic tax reform, which would diminish the pension system's dependence on the taxation of the labour force, it will be impossible to ensure its long-term stability.

In this context, it is obvious that increasing the potential of private pension funds, without attending to the reformation of the crumbling system, is at least irresponsible, if not immoral. And most importantly – extremely short-lived, since only a completely naive individual can believe in fairy-tales that as the income of the employed grows, the pension system will be enriched and will start functioning perfectly. In such a case, one should also believe that in the deteriorating demographic environment, salaries and wages will be growing very quickly, though nobody is actually going to raise them for the Baltic States' pensioners, who have one of the smallest pensions in Europe and who will still not demand for any increase! Such fairy-tales can only be taken for granted by politicians, for whom the most important thing is to refrain from making any complex decisions and who will be the first to raise those pensions as the elections approach; as well as by Scandinavian pension fund managers' representatives in the Baltic States, for whom it's indispensably necessary that assets managed by the funds would grow this year, and that shareholders will be happy and that they can receive their annual bonuses.

About pension funds' activities and Poland's example, which has decided to nationalise part of the billions accumulated in private pension funds, it is elaborated further on in more detail in Monika Poškaitytė's article "Are Scandinavian Banks Sucking the Blood of the Baltic States' Pensioners?” Here we only wanted to draw Scandinavian pension fund managers' attention to how their activities contribute to the realisation of an irresponsible policy. So, when politicians are thinking of rescuing the drowning pension system with the help of the money accumulated in the pension funds during every next economic decline, that will not only be the result of political populism, but also of the irresponsible and "Dracula-like" behaviour of the pension funds themselves.

We deliver, UAB is not responsible for advertisers content or information published graphical material Contacts: +370 (613) 87583, info@wedeliver.lt