Roubinisation of Financial Markets: What Are Financial Gurus Forecasting for the Year 2014?

Artūras MILEVSKIS, Head of the Investment Management Unit at "Synergy Finance", lecturer at investavimas.lt, lecturer at the International Business School of Vilnius University

A major portion of the year 2013 is already in the past, so it may be asserted with confidence that it was full of surprises. Who could have ever thought that it would be this year that the United States of America would find itself only one day away from a declaration of bankruptcy, or that approximately 1 million U.S. federal workers would be compelled to take unpaid vacation for more than two weeks? Who could have ever guessed that the stocks of the developed countries would be the leading asset class this year, and that they would outperform the stocks of the developing countries by more than 20%? How many were there prognosticating that the price of gold from the beginning of the year would have been corrected by more than 20%?

Of course, if we returned to the beginning of the year 2013, we would find a great number of very diverse forecasts, both pessimistic and optimistic. However, it will only be when the year finally ends that we will be able to say exactly who were right and who "missed" completely. But as most of you have probably understood from the title of this article, we are not going to talk about the past today, since it's much more sagacious to talk about the future, so further on we are going to review what is being said by the authorities of the financial world about the prospects of the world economy, stock markets, gold and currencies.

Surely, at this point most of you could be confronted by an elementary question: "Why should one delve into what is being forecasted by various gurus if eventually most of such forecasts prove to be wrong?" The answer would be very simple – knowing the opinion of the majority, one may give a try at seeing what they possibly do not see.

Let's begin with the world economy

First of all, let's take a look at what is being forecasted by the International Monetary Fund (IMF) or its CEO, Christine Lagarde, for the world economy in general and for different world regions separately. The World Economic Outlook report as issued by this institution in October this year shows that the growth rate of the world's gross domestic product as forecasted by the IMF for the year 2014 will be 3.6%. This figure should exceed the growth rate forecasted for the year 2013 by approximately 0.7% or even by a quarter. The developed countries have been forecasted to enjoy an economic growth of barely 2.0% in 2014, whereof the biggest positive effect should come from the U.S. economy (+2.6%), which means that the greatest amount of the entire growth of the world economy will be carried "on the shoulders" of the economies of developing countries, which have been forecasted by the IMF to enjoy a growth of 5.1% in 2014.

Hence, relying specifically on the forecasts furnished by the economists of the International Monetary Fund, a conclusion may be drawn that a positive trend is expected next year. However, there arises the question of whether the same "rosy" prospects are being discerned by the representatives of other institutions. For example, Bill Gross, Manager of the "Pimco Total Return Fund", the world's biggest bond fund, whose managed assets are currently approximately 248 billion U.S. dollars, asserts that the growth of the world economy will be weaker next year than forecasted by the majority of analysts and will barely reach 2.5%, which is almost one-third less than forecasted by the IMF. What is influencing such a considerable divergence? According to Bill Gross, since the 2009 crisis, the world has entered the so-called "New Normal" regime, i.e. where both economic growth and inflation are holding steady at very low levels, and that in the nearest future, there's nothing left apart from adapting to such an environment.

So, what is the famous Nouriel Roubini saying about the world economy and the key financial markets? According to him, the world economic activity is recovering very slowly, economic growth is meagre, inflation is low and the unemployment level is high. Such a reality determines extremely low interest rates in the key economies and a variety of economic promotion programmes. However, the worst thing is that these programmes, which should help the real economy and should encourage capital investments and the creation of new jobs, are failing to perform their main function. Most of the excess liquidity goes to diverse asset classes such as real estate, stocks, high-yield bonds, etc. According to N. Roubini, price bubbles are already perceptible in the real estate markets of such countries as Switzerland, Sweden, Norway, Germany, Brazil, Singapore and China. If such a situation continues, a moment will be eventually reached when many countries and most asset classes will be overwhelmed by such bubbles, upon whose burst a sudden and deep recession awaits.

What are the forecasts for global stocks?

Before presenting the forecasts of several different investment gurus for stock markets in 2014, let's first remember what has occurred over the last 5 years. The current bull market commenced in March, 2009, i.e. after the biggest financial crisis in the last 70 years. During the crisis, the global stock index had lost more than 50% of its value, which means that stock prices were relatively low and that the investment sentiment and expectations of the future were rather subdued. What's most comical is that this period proved to be an especially good moment to invest!

So over the last four-and-a-half years, global stocks have managed to rise in price by approximately 150%, which means that the average annual return of the period in question reached as much as 22%. What do you think, is that a lot or little? When analysing the history of the last 50 years, it can be observed that the average bull market used to last approximately five and a half years and during this period, stock prices used to rise by approximately 170% on average. Just having these facts allows one to draw a simple conclusion: considering its duration and growth, the current bull market should be approaching its end. At the present moment we should not be too surprised if, after such an impressive period, we meet an ever increasing number of optimists who, based on the past results, will not hesitate to suggest investing in stocks. However, the most interesting thing is, what are the most renowned investors saying about the future?

One of the most famous U.S. stock strategists – Laszlo Birinyi, who had quite accurately foretold of the U.S. stock market's bottom in 2009 and the following recovery, is currently forecasting a further rise in the U.S. key stock index S&P 500. According to him, the U.S. stock market is presently in the fourth or last stage of the bull market, which may extend one or two years further. He also thinks that over this period, the biggest world economy's – U.S. – stock index should climb over 2,000 points (the current value being 1,762 points), and that before a decline in prices starts, the stock index may even reach 2,500 points (approximately 40% higher than at the present moment). His thoughts are basically accepted by the majority of Wall Street's strategists, who likewise assert that the U.S. key stock index S&P 500 should exceed the limit of 2,000 points sometime next year, or in the worst case, in 2015.

However, the most interesting thing is that Mr. Birinyi is associating the further rise in stock prices with investors' euphoria. He deems that most investors, after the last four especially-lucrative stock market years, finally will not withstand and will decide to replace safe investments such as cash or bonds with more aggressive investments such as stocks. This psychological turning-point will be sudden and on a mass scale, and will evoke a final rally of stock prices which will inevitably evolve into a bear market.

Nevertheless, notwithstanding such tremendous optimism emanating from the majority of investment gurus, single pessimists can also be found. For instance, Robert Shiller, this year's Laureate of the Noble Prize in Economics, maintains that U.S. stocks are relatively highly priced (he relies on the indications of his own CAPE index). According to him, the current pricing of U.S. stocks is at its highest since 2007, which means that, when investing in stocks for the next 5 or 10 years, one should expect poorer results than the long-term historical annual-profitability average of approximately 9%. Of course, this does not mean that U.S. stocks are going to suffer the losses that were witnessed in 2008 – 2009 for a second time, but one needs to understand that after the almost 5-year long rally of stock prices, optimists who now invest in stocks are prepared to pay practically twice as much for the same one Litas of profit. Most often, it also means that one will have to wait twice as long until the investment pays off.

The yellow metal

Before presenting the diverse forecasts of gurus for gold, I would first like to furnish a couple of very concrete facts. Over the last 10 years, the price of gold has risen by approximately 14% per annum. Considering that this result has practically surpassed all other investment instruments, it's no wonder that during the same period, there was also an increase in the interest shown in this investment instrument. Meanwhile, the second fact is that during the last 2 years, the price of gold has been constantly decreasing and since its peak, it has already lost nearly one third of its value. Most interestingly, this extremely poor result has not diminished the interest shown in the noble metal, and some are still further forecasting incredible profits for gold lovers. So, what are the gold gurus saying about the future prospects of gold?

Peter Schiff is one of the most passionate gold lovers, who warned all investors in 2006 of the approaching "greatest crisis of the century", and is quite assuredly tossing around further forecasts about growth in the price of gold. He asserts that the price of gold over the course of years could exceed 2,000 U.S. dollars per troy ounce, which means that the price of gold from its current value should shoot up by nearly 50%! What's the main reason for making such a forecast? From a realistic point of view, nothing has changed – the U.S. continues to print money (like the central banks of most other countries), the amount of money within the system is growing, countries' debts continue to rise, etc. According to Mr. Schiff, we are inevitably drawing closer to the moment when countries will start going bankrupt. For instance, he forecasts that before the tenure of the current U.S. President, Barack Obama, ends in 2017, the U.S. will default on paying the interest on its debt and will be compelled to declare bankruptcy. Given such a situation, gold should become one of the main hedging instruments. Should countries go bankrupt, the price of gold could rise considerably, and only those investors who have purchased real gold will be able to retain and possibly even experience growth in their assets.

Peter Schiff's forecast is accepted by another famous investment guru, Marc Faber, who has been reprimanding the U.S. central bank's managers for quite a long time and has been constantly recommending the purchase of physical gold. According to him, no single asset class is safe presently – neither bank deposits nor U.S. stocks or bonds, but if the price of gold happens to reach a price of 1,200 – 1,250 U.S. dollars per troy ounce once again, he is certainly going to buy some extra gold and recommends the same for others.

What is most interesting is that two years ago, as the correction in the price of gold started, none of the above-mentioned two specialists made any comment as to the impending extremely huge losses, and since the price of the noble metal has dropped by 30%, no other choice is left apart from saying that cheaper gold is a much more attractive investment alternative while in quest of culprits.

However, when it comes to gold, unlike in the analysis of stocks, there exists a different camp – i.e. the commodities [raw materials] analysts of most banks like Goldman Sachs or Deutsch Bank. Most of them, as if agreed to in advance, are forecasting lower prices for the noble metal. For instance, Jeffrey Currie, Head of Commodities Research at the U.S. investment bank Goldman Sachs, forecasts that the average price of gold should be at least 1,050 U.S. dollars per troy ounce in 2014. According to him, such weakness in the price will correlate with the fact that as the economies of the U.S. and other regions are recovering, there will be a decline in the need for promoting such economies and printing money. In turn, the threat of global crisis and high inflation will be accordingly diminished, which will lead to a greater reduction in demand for instruments used to hedge against these events – for instance, gold.

Conclusions

In an attempt to sum up the thoughts of all the economists, investors and analysts mentioned in this article, two directions of forecasts can be distinguished: optimistic and pessimistic. The optimists assert that economic activity in 2014 should recover, which should also positively affect corporate profits and stock prices for a while. Meanwhile, the improving economic situation, especially in the United States of America, will allow the Federal Reserve Bank to start diminishing its promotion programme, which, in its own turn, should adversely affect the prices of bonds and gold.

In the meantime, the pessimists’ camp asserts that the economic incentive policy implemented by the central banks of the major countries provides no real benefits for the economy and instead, just inflates the prices of financial assets. Should these bubbles burst and should a global recession start, bankruptcies of countries may ensue, in which case gold is referred to as the only source of salvation.

As we can see, as many people, as many opinions. Let's not forget that forecasting the future is an especially complex and intricate task, even for those gurus who once managed to guess it earlier. So therefore, use your own head, don't take the forecasts of any guru for granted and be prepared to embrace the unexpected in 2014. None of us knows exactly what is waiting for us around the corner of "The New Year".

Inserts

The illusion of forecasting

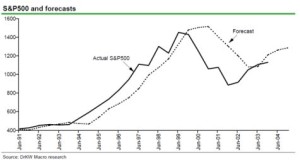

Research conducted by "DrKW Macro Research" shows that forecasts for macroeconomic and corporate performance, bond yields and future stock prices just follow factual data, and not vice versa as imagined by many. In other words, it's not the forecasts furnished by specialists that show what's ahead in the future, instead, it's factual data that suggests how economists and analysts are going to forecast. As an example, let's take the values of the U.S. stock index S&P 500 and the forecasts furnished by stock strategists for the same index. If we shifted the curve of the stock index in question a couple of months forward, then we would have two curves practically coinciding with each other.

Bill Gross

William Hunt "Bill" Gross is the manager of the world's biggest bond fund, the "Pimco Total Return Fund". The fund currently manages assets worth approximately 250 billion U.S. dollars. Over the last 14 years, the average annual return of the fund run by him was equal to 7.4%, surpassing its benchmark, i.e. the aggregate basket of U.S. bonds, by as much as 1.1%.

Nouriel Roubini

Nouriel Roubini is an economist, lecturer and thinker. He has earned wide recognition from financial-market players after having accurately foretold the burst of the U.S. real-estate bubble in 2007 and the global recession of 2008. Roubini is most often known for his negative forecasts, and is therefore called "Dr. Doom". Notwithstanding his previous successful forecasts, during the last couple of years he also managed to err. For instance, after the global crisis had ended, he still continued for quite a long time to maintain that the recovery would only be short-lived and very meagre, but as almost 4 years have now past, he has begun to slightly change his opinion to a more optimistic one.

Laszlo Birinyi

Laszlo Birinyi is a stock analyst and investor, as well as the founder of Birinyi Associates. The firm that he founded is engaged in stock analysis and investment management. He started his career in investment in 1976. He was widely praised when he accurately foretold the U.S. stock market's bottom in 2009 and the following rise in prices. He was one of the few who asserted from the very beginning that this bull market would be strong and would surely last more than a few years. So far this guess of his has proved correct, but at this point the rest of his guesses should also be remembered. For instance, before the drop of U.S. stock prices both in 2008 and in 2000, Mr. Birinyi forecasted a rise in stock prices, but it all happened completely to the contrary – the two biggest stock-market crashes for the last 30 years soon followed.

Robert Shiller

Robert Shiller is a U.S. economist, academician, author of books, and a Nobel Prize Laureate. Presently he is ranked as one of the 100 most influential economists in the world. In his book "Irrational Exuberance", published in 2000, he warned about the price bubble forming in U.S. stocks, and especially in information technologies, about the possible burst of such a price bubble and about the huge losses that may ensue. Whereas in the second edition of his book, which was published in 2005, he warned that the rising real estate prices may lead to extremely woeful consequences: the inevitable crash of real estate prices and the ensuing financial panic.

Peter Schiff

Peter Schiff is an entrepreneur, investment broker, and author. He is known for his especially negative forecasts for the U.S. economy and national currency, though he speaks positively of commodities [raw materials], especially of gold, and other countries' currencies and stocks. He became famous in 2008 after having correctly foretold of the great recession and the burst of the stock and real estate price bubbles. However, notwithstanding this accurate guess, the majority of his forecasts made thereafter did not prove to be very correct. He maintained that the bouncing back of stocks that commenced in 2009 would only be short-lived, that the price of gold over the course of several years was going to reach 5,000 U.S. dollars per troy ounce and that the U.S. dollar would continue to weaken in respect to other major currencies.

Marc Faber

Marc Faber is a Swiss investor and author of the well-known monthly newsletter, "Gloom Boom & Doom Report". During his fairly long career in personal investment, he produced a great number of recommendations, but the first recommendation that made him famous was made in 1987, when he recommended that his customers sell the stock positions they possessed. For those who don't know, in October 1987, the U.S. stock indices lost approximately 20% of their value in one day. He also warned about the Japanese stock price bubble in 1990, the U.S. stock price bubble in 2000, as well as the price bubbles in stocks, real estate and commodities [raw materials] in 2008. Nevertheless, the recent years have not been very successful for him. For instance, in 2013, Mr. Faber forecasted huge losses for global stocks and a profitable year for gold, but, as we now know, the situation is completely the opposite.

Bill Gross

Bill Gross: Get used to low rates 'for decades'

http://money.cnn.com/2013/10/02/investing/bill-gross-interest-rates/

PIMCO Cyclical Outlook: A Fine Balance in the Global Profits Cycle

World Economy

World Economic Outlook Reports

http://www.imf.org/external/np/tr/2013/tr100813.htm

Nouriel Roubini

Laszlo Birinyi

Birinyi Diverges From Einhorn Short Forecasting S&P 500 at 1,820

Birinyi says we’re heading to S&P 2000

http://www.marketwatch.com/story/birinyi-says-were-heading-to-sp-2000-2013-09-13

http://www.pundittracker.com/pundits/profile/laszlo-birinyi

Robert Shiller

On the pricing of U.S. stocks

Peter Schiff

Gold Bug Schiff Counters Goldman on First Drop Since 2000

Marc Faber

Faber Sees Gold in 'Buying Range' at $1200-$1250

http://search1.bloomberg.com/search/?content_type=all&page=1&q=Marc%2BFaber

Marc Faber 2013 Economic Forecast: Gold, Oil, Stocks, Bonds, Equities

http://www.youtube.com/watch?v=N3gw2YXULZs

Gold Outlook Predicated on U.S. Data: Currie

Ukraine’s Choice – Bad News for Business!

by Vadim Volovoj, Baltic Economy Deputy Editor

Is it worthwhile for a business to enter the Ukraine as a market? In recent years, the answer used to be - "No". That has been demonstrated by the fact that a great number of solid foreign companies have withdrawn or intend to withdraw from the Ukrainian market. Want to know why and what should be done in order to change the situation? Read the article.

Key words: Ukraine business climate, Ukrainian Oligarchs, Ukraine European Union Association Agreement, Customs Union, Kremlin, Russian Business Culture.

Energy Independence, Gazprom Pipelines and Andersen’s Fairy Tales

by Eduardas Eigirdas, Baltic Economy Editor-in-Chief

The European Union is one of the the largest energy markets in the whole world, so it would be reasonable to expect that the prices of energy resources in this market would be among the lowest, thanks to the economies of scale. But that is not the case. This article explains why.

Key words: European Union, Renewable energy resources, Green energy, Baltic electricity prices, Baltic electricity market, Denmark, Russia, Gazprom, Lithuania, Ignalina Nuclear Power Plant, EU Communiqué regarding state intervention in the electricity sector.

The EU Has Already Gone Through Its Most Severe Phase

In this interview, we are speaking to Ms. Dalia Grybauskaitė, an economist and a former EU finance and budget commissioner, not just because she is the President of Lithuania, which is currently presiding over the European Union, and not just because she was awarded the prestigious Charlemagne Prize by Germany in 2013, also dubbed the "Oscar in Politics", for Lithuania’s contribution to the unity of the European Union and to the economic stability of all Europe. We are speaking to the President because her vigour and consistency represent faith and belief in a strong Europe, in the flourishing Baltic Sea Region and in the pro-European future of Eastern neighbours.

VALSTYBĖ / THE STATE: Which global and European economic trends in the light of the year 2014 do you find disconcerting and which ones optimistic?

Primarily I would like to begin with what’s good and optimistic. The main centres of the global economy are forecasting growth in 2014, though not to such an extent as we would like, especially in Europe. The growth in Europe is forecasted to be small – approximately 1.5 percent, in the USA – 2.5–2.6 percent, and in China – over 7 percent. But it’s not good. It’s disconcerting that that the growth in the USA and in Europe is rather slow and recovery – rather painful, but positive things can also be discerned there. I would really like to take an optimistic view of the future.

I think that the biggest challenges to be faced by the world economy are going to be never-ending wars in those regions that are suppliers of energy resources, i.e. in Central Asia, the East and Syria. That may affect both the prices of energy resources and the economic recovery in the whole world, but so far the main centres are demonstrating a positive growth. I hope very much that it’s going to be big strides, which will facilitate overcoming the complicated economic situation.

VALSTYBĖ / THE STATE: The European Union (EU) has often been depicted as a crumbling giant. What do you think? Is it possible to assert with a view to the forthcoming year that the fundamental issues in Europe have managed to be more or less handled and now a phase of somewhat more stable growth has commenced?

I think that we could have been apprehensive ourselves or demoralized by others in view of the crumbling a couple of years ago, when a much more complicated situation ensued in Southern Europe. But even Greece, for which it certainly has not been easy, it has already been facing six years of economic crisis and a complicated situation, might be starting to grow by next year. During the last two years, the EU has managed to adopt important decisions oriented towards the medium or even long-term perspective. I’m bearing in mind certain processes pertaining to the creation of the Banking Union and economic-policy coordination processes as well as common criteria about how the budget should be maintained and its adoption process should be coordinated in the national states. Hence, there are a number of things that will help us, especially in the future, to manage and cope with the situation more easily so that it could be prevented from deteriorating or impacting certain countries. Of course, it’s not a huge integration yet, it’s just very small steps towards a larger integration into the EU – towards economic, and not political, integration.

Nevertheless, though these hard times are very severe and in some countries very protracted, they are already headed towards the end. Their consequences will still be felt for a while, but I see no reasons why, for instance, that the Euro should flounder or why a more complicated situation would evolve in the Eurozone.

VALSTYBĖ / THE STATE: What EU decisions intended to be adopted or already adopted do you think could strengthen the bloc’s positions in the nearest future, especially when one has to compete with the USA and China?

That’s, among other things, the new seven-year European budget, which is mostly oriented towards innovations and pan-European connections in the fields of energy and services as well as in electronics and cyberspace. Many good initiatives exist that are indispensable and will help Europe become more competitive. These are huge steps in the pursuit of a common energy policy, especially in the fight against monopolistic domination in Europe in the supply of gas or other energy resources. The European Commission, for practically the first time, has overtly taken actions against monopolistic supply. I’m bearing in mind "Gazprom". It shows that Europe is able and has the political will to fight and defend its interests through the use of existing legal measures in the pursuit of a more competitive base for the whole economy.

Decisions that have been adopted are abundant, though not all of them are going to produce quick results. Another decision that is very important to the entire international community is giving a mandate to the European Commission to launch negotiations with the USA over a free trade agreement. I would guess that this particular decision is vexing and irritating to some, since some attempts have been made to influence the public opinion as well as the EU parliamentarians’ opinion so that these negotiations would be put on hold for one or another reason. We have received a response from third parties – hence, we are on the right track. This agreement will provide benefits and enhance the competitiveness of both the USA and Europe.

VALSTYBĖ / THE STATE: The Baltic Region is often talked about. You are a person who constantly stresses that such a region does exist, and that it has certain common values and goals. What are those interests and goals? What general-welfare vision is uniting us and why is it valuable?

First of all, it is valuable to have a region that can be trusted, where one feels safe and where trade and economic relations are transparent and reliable – a region where there are no surprises, where our people can travel and live safely and where cooperation rests on civilised rules based on international law. Such is the Nordic Region.

We are really no rivals in ambitions or in the size of population. On the contrary – our economic systems are very similar – they’re regulated market economies. Our democratic values are likewise similar, for instance, in terms of the protection of human rights. Hence, the Baltics is truly a region that unites a great number of countries not only economically, but also politically, and even in terms of security, since we are cooperating with the Nordic countries in integrating our economic needs and energy market as well as in solving security issues.

The main investors in Lithuania mainly come from the Nordic countries. Scandinavians are in the top ten. For instance, Sweden has already invested over 9.5 billion Litas here. This country is one of the biggest investors. Poland is second, and third, Germany. We are maintaining relations with Finland, which is also investing in our country. I’m bearing in mind the modern combined heat and power plant that was launched in Klaipėda not quite long ago, which not only uses bio-fuel, but also waste, and not only produces electricity, but also heat.

Indeed, the support received from the very beginning of the restoration of our independence was both moral and economic, and now we see that we are almost equal participants in this region. We are very successful. Even others, having taken a detached view of us, are willing to be friends and cooperate with us. For instance, the United Kingdom is trying to join our format and we are gladly inviting them as observers. It’s clear and evident in the European Council that our interests are shared: before every meeting, we still come to discuss and coordinate our opinions on all matters in the NB6 format (Nordic and Baltic countries). This takes place at the levels of Presidents, Prime Ministers and the European Council. We are cooperating very closely, which is very understandable since regional grouping in the expanding Europe is a natural process. Sooner or later it had to occur, it was just necessary to identify in which region our interests coincided most, where our voice is equal and where our opinion matters. I think that the Nordic Region is such a region, where we can feel the most secure, most reliable and, probably, the most dignified.

VALSTYBĖ / THE STATE: Let’s talk about the East. What do you think? Will the EU manage to find an antidote to the actions of such states as Russia that are targeted against the interests of one of the EU countries, irrespective of whether we are talking about the energy sector or trade?

Unfortunately, so far we can only see that our Eastern neighbours do not always act logically and reliably, so we can surely see actions that are neither careful nor measured in trade and other sectors. Such actions are very difficult to explain, and no explanations have been offered yet. I’m bearing in mind the inspection of vehicles and the boycott of milk products. I’m very pleased that our situation was evaluated in the EU swiftly and objectively. It was judged to be the same as sanctions or actions against the EU itself, especially since we are all members of the World Trade Organisation. Consequently, we have received support, which is very pleasing – we have not been left on our own. I think that the publicity has done much more damage to the international prestige of Russia itself than to us, and has also shown that in the 21st century, non-civilised measures may not be employed in respect to neighbours.

VALSTYBĖ / THE STATE: Today, Lithuania is presiding over the EU. What does it mean to our country? Does this fact tell the world anything about the EU’s future, its values and the opportunities that arise when the EU is united?

It says a lot. First of all, we are the first Baltic country to take over the presidency after almost a decade’s membership. It shows that a state, which has only been independent for 23 years, has managed to make very big progress in a short amount of time and has even been appointed for running the main activities of the EU. So far we are doing quite well. This shows that even a small state is important in the EU, and can only be important if it knows how to use all its leverage of power as a small state professionally and honestly.

Critics say that Lithuania’s foreign policy is dim and that we have no friends. I would like to say that we have 187 friends all across the world. Many of them voted that we should preside over the Security Council of the United Nations Organisation. So many votes were never cast for anything before. I would like to express joy that our visibility and rational diplomatic power as a small state have produced these results. From now on, even a small state is going to have a great number of de facto powers to exert influence over the EU’s expansion and to participate in the decision-making and expansion processes, for instance, in the Eastern Partnership Programme. I think that it has been an excellent trial and opportunity for Lithuania, and so far we are making use of it really quite well.

VALSTYBĖ / THE STATE: Thank you for the conversation.

Interviewed by Eduardas EIGIRDAS

The Investment Climate for 2014

Most financial institutions publish their forecasts, but not all of them are completely solid. EVLI stands out as a competent and trustworthy investment bank, operating in Nordic and Baltic countries. Therefore, looking forward to 2014, Baltic Economy magazine talks to “Evli Securities AS” Management Board President Jolanta Latvienė.

Key words: Investment climate 2014, Regions of concern, Countries of concern, BRIC, US economy, EU economy, Baltic countries economy, Scandinavian economy.

We deliver, UAB is not responsible for advertisers content or information published graphical material Contacts: +370 (613) 87583, info@wedeliver.lt